Reducing PBGC variable rate premiums: contribution timing

Pension Benefit Guaranty Corporation variable-rate premiums have been going up dramatically. The simple way to think about this premium is as a tax on underfunding. That tax went from 0.9% in 2013 to 2.4% in 2015. In 2016 it will be 2.9% or 3.0% (the percentage is indexed to average national wage increases) – more than tripling in three years.

This increase has led sponsors to look for ways to reduce these premiums. In this article we review the strategies for reducing PBGC variable-rate premiums available to sponsors. We then focus on one specific strategy – accelerating (by one to five months) 2015 funding.

For all purposes we will assume we are dealing with a calendar year plan; so we will not be discussing fiscal year plan year timing issues. And we will assume we are dealing with a frozen plan, so we won’t be considering, for example, the calculation of normal cost.

Strategies for reducing PBGC variable-rate premiums – four types of plans

What premium-reduction strategy you use depends on what sort of plan you have – critically, how well funded your plan is. In this regard, there are four types of plans:

Plans that are fully funded on a non-HATFA basis. Sponsors of plans that are fully funded without regard to the interest rate stabilization rules under the Highway and Transportation Funding Act (HATFA) generally will not owe any PBGC variable-rate premium.

Plans that are fully funded on a HATFA basis but not on a non-HATFA basis. Sponsors of plans that are only fully funded if you apply the HATFA interest rate stabilization rules still owe PBGC variable-rate premiums (as discussed below, those premiums are calculated without regard to HATFA). Many sponsors of these plans will find the borrow-and-fund strategy discussed in our article PBGC variable premium vs. borrow-and-fund: impact of higher premiums compelling.

Plans that are not fully funded but are at least 80% funded on a HATFA basis. Sponsors of these plans generally can reduce PBGC variable-rate premiums by accelerating 2015 contributions by a few months (paying any remaining required contribution for 2014 by April 15 and quarterly contributions due on October 15 and next January 15 by September 15).

Plans that are not 80% funded on a HATFA basis. The acceleration strategy described in (3) is generally not available to these plans. That is because that strategy depends on using a ‘credit balance’ to satisfy 2015 funding obligations, and a plan must be at least 80% funded in 2014 to do that. Plans in this group are often subject to the variable-rate premium headcount cap, however, and sponsors of these plans may want to review our article Reducing pension plan headcount reduces risk and PBGC premiums, explaining how plans subject to the headcount cap can reduce variable-rate premiums (and reduce risk) by paying out lump sums.

The remainder of this article focuses on the acceleration strategy described in (3). and thus is generally relevant only to plans in group 3 – plans that are not fully funded but are at least 80% funded on a HATFA basis.

Background – calculation and timing of funding and variable-rate premiums

To describe that contribution acceleration/PBGC variable-rate premium reduction strategy, we must begin with a brief review of the basic ERISA/PPA funding and premium calculation and timing rules.

Calculating the FTAP and UVBs

Minimum funding requirements and PBGC variable-rate premiums for the current year (e.g., 2015) are both calculated based on the plan’s assets-to-liabilities funding ratio as of the end of the prior year (e.g., 2014). For minimum funding, that ratio is called the funding target attainment percentage (FTAP), and, unless the sponsor has elected otherwise, it is calculated applying the interest rate stabilization rules under HATFA.

PBGC variable-rate premiums are calculated based on the plan’s unfunded vested benefits (UVBs). UVBs are, generally, the plan’s liabilities for vested benefits minus the fair market value of plan assets. Liabilities for this purpose are determined using ‘spot’ PPA first, second and third segment rates (or, at most, 24-month averages of these rates), but without applying HATFA interest rate stabilization.

For a typical plan, the 2015 liability for PBGC premium purposes is about 25% higher than that calculated under HATFA funding rules.

Timing of funding

Generally under PPA, the sponsor must make a contribution each year sufficient to pay off a portion of the pension shortfall – the gap between FTAP assets and liabilities. Depending on plan funding history, the shortfall payment is generally equal to 20%-30% of the shortfall.

Generally, if there is no quarterly contribution obligation, contributions for the current year (assuming applicable extensions) must be made on or before September 15 of the following year. So, for 2015, the contribution may be made on or before September 15, 2016.

Quarterly contribution rules

Plans that have a funding shortfall for the prior year are required to make quarterly contributions for the current year. Quarterly contributions must be made on April 15, July 15, October 15 of the current year and January 15 of the following year.

The amount of each quarterly contribution is equal to 25% of the lesser of (1) 90% of the minimum required contribution for the current plan year and (2) 100% of the minimum required contribution for the preceding plan year.

To the extent not met by quarterly contributions, the plan’s minimum funding obligation for the current year, plus interest, is due (assuming applicable extensions) not later than September 15 of the following year. We’re going to call this the ‘true-up’ contribution. So, for 2015, quarterly contributions will be due April 15, July 15 and October 15 of 2015 and January 15, 2016; and any final (true-up) contribution would be due September 15, 2016.

PBGC variable-rate premium timing

For current year variable-rate premiums, UVBs are determined as of the end of the prior year. Contributions for that prior year may be made by September 15 of the current year. So, a contribution made by September 15, 2015 (for 2014) will reduce 2015 UVBs and 2015 variable-rate premiums. Those premiums (for a calendar year plan) must be paid by October 15, 2015.

* * *

With this background, let’s now discuss how a sponsor may modestly accelerate the payment of contributions and reduce PBGC variable-rate premiums, using an example of a ‘type (3)’ plan described above.

Minimum funding example

Let’s assume a plan that has $80 million in assets and $100 million in liabilities (on a HATFA basis) as of December 31, 2014. Thus it has a shortfall for 2015 of $20 million. And let’s assume: (1) the plan was 80% funded in 2014, (2) the plan owes a true-up contribution for 2014 of $500,000, and (3) the 2015 minimum contribution requirement is $5 million and exceeds the 2014 required contribution.

These valuation results, along with the calculation of the 2015 quarterly contribution requirement, is summarized below:

1/1/2015 Valuation Results | |

(1) Assets | $ 80,000,000 |

(2) HATFA liability | 100,000,000 |

(3) 2015 required contribution | 5,000,000 |

(4) Quarterly contribution, (3) x 90% / 4 | 1,125,000 |

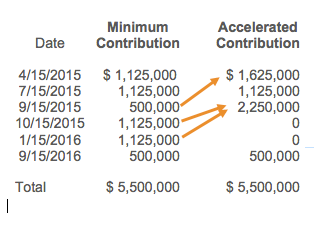

Based on these results, the schedule of upcoming required contributions looks like this (note: we are ignoring interest for the sake of simplicity):

Date | Minimum Contribution |

4/15/2015 | $ 1,125,000 |

7/15/2015 | 1,125,000 |

9/15/2015 | 500,000 |

10/15/2015 | 1,125,000 |

1/15/2016 | 1,125,000 |

9/15/2016 | 500,000 |

Total | $ 5,500,000 |

As expected, total contributions equal the sum of (a) the 2014 ‘true-up’ contribution, and (b) the 2015 required contribution.

Accelerating contributions to reduce variable-rate premiums

Recall that contributions made by September 15, 2015 can be included in assets ‘as of’ January 1, 2015, provided the contributions are made for the 2014 plan year. In the example above, only the $500,000 ‘true-up’ contribution due on September 15 is included in the $80 million of plan assets ‘as of’ January 1, 2015.

Now let’s compare the schedule above with the accelerated funding schedule below:

By adopting the modest acceleration above (and making ‘credit balance elections’ to satisfy quarterly contribution requirements), the plan can consider all $5 million in accelerated contributions made by September 15, 2015 as being ‘for’ 2014, increasing plan assets ‘as of’ January 1, 2015 by $4.5 million versus the minimum funding example.

The additional $4.5 million in plan assets reduces the plan’s PBGC UVB as of January 1, 2015 dollar for dollar, thereby reducing the PBGC variable premium due on October 15 by $108,000 ($4.5 million x 2.4%) without increasing the cash contributions to the plan at all.

Note that in the above example, the 2015 ‘true up’ contribution is still shown as being made on September 15, 2016. Of course, sponsors that adopt the modest acceleration of pension funding described here will likely make the strategy permanent. As the PBGC ‘tax’ on underfunding continues to increase, the value associated with an accelerated funding strategy will continue to grow.

Leaving money on the table

The focus of this article has been on ‘type (3)’ plans – plans above 80% funded, but not overfunded, on a HATFA basis. Based on our analysis of publicly-available data, about 20% of plan sponsors are currently in this position.

Within that 20%, at least 118 pension plans, with more than $25 billion in total assets, fit the profile described in this article: they made minimum contributions for 2013 rather than adopting the modest acceleration discussed above.

These plans paid a total of $60 million in PBGC variable premiums during 2013 – an amount that could have been reduced by almost $8 million with modest funding acceleration.

For 2015, the variable premium is more than 2.5 times the 2013 rate, so these numbers will likely be 2.5 times as large for 2015.

* * *

Some sponsors may be unaware of the big increases in PBGC premiums coming down the pike. In October, when the PBGC premium comes due, many sponsors will suffer sticker shock, with premiums several times larger than in previous years.

In October, it will be too late to do anything. But, between now and then, sponsors have the ability to take some simple steps that could result in substantial savings later this year.