Retirement income, inflation, and retirement finance

The Consumer Price Index (CPI) has steadily risen throughout the year, with prices in September 2021 5.4% higher than the beginning of the year.

This represents, fundamentally, a reduction in the buying power of a (nominal) dollar since the beginning of the year. How does this affect retirees and those saving for retirement?

The effect of inflation on retirement income

For a DB participant with a deferred to 65 life annuity benefit of $1,000 per month, 2021 inflation has reduced that the real value of that annuity to $950. That is, an annuity that could buy $1,000 in goods and services a month in December 2020 can now (our data goes through September 2021) only buy $950 of those same goods and services.

The effect on a defined contribution plan participant is more complicated. The participant’s benefit is defined as his account value. Converting that to retirement income requires (critically) considering the effect of changes in interest rates on the “cost” of retirement income (e.g., annuitization), with increases in interest rates reducing this cost and decreases in interest rate increasing the cost.

Adding significant inflation (such as we are experiencing in 2021) to this calculation affects several variables critical to the calculation of DC retirement income: First, and obviously, it reduces the buying power of the participant’s (old) retirement income target. Second, it affects interest rates (and thus the cost of annuitization). Third, it has an (ambiguous) effect on the participant’s account/assets. Purely financial assets (e.g., bonds) are negatively affected by inflation: the purchasing power of the coupons goes down in value and, to the extent that inflation pushes up interest rates, the price of bonds goes down. Real assets (e.g., real estate investments or stock companies that hold significant real assets) are much more likely to preserve their real value in response to higher inflation.

Charting the effect of inflation

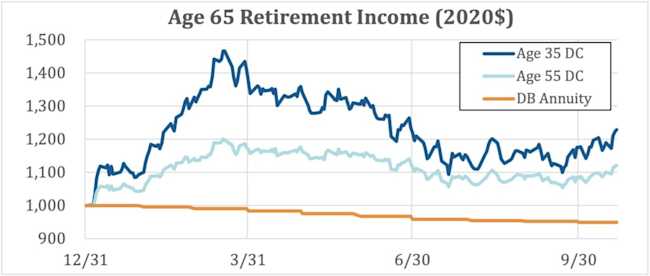

To track the effect of market performance on the retirement income produced by a participant’s DC account, we have tracked the effect of asset gains/losses and interest rate increases/declines for two example participants ages 35 and 55. (We determine asset performance assuming the 35-year old is invested in a 2050 target date fund, and the 55-year old is invested in a 2030 target date fund.) In the chart below, which provides this calculation for 2021 year-to-date (through October 21, 2021), we add the effect of inflation, by showing this performance in “2020 dollars.” Finally, we’ve added a line to this chart to reflect the effect (in “2020 dollars”) of inflation on a traditional DB plan participant holding a promise of a $1,000 monthly life annuity beginning at age 65.

As the chart indicates, our example DC participants’ retirement income position has improved considerably over 2021, with improvements in asset values and increases interest rates offsetting the effect of inflation. Not so the DB participant, who saw the real value of his annuity decline by the amount of inflation.

What explains these results?

The retirement finance risk “bundle”

Retirement finance – most abstractly, the accumulation of assets today to produce retirement income in the future – includes a bundle of risks: asset performance (affecting the size of the account); interest rate performance (affecting how much income the account can buy); and inflation (affecting how much goods and services that income can buy).

All of these risks affect each other: In the asset and interest rate markets, inflation can affect the level of interest rates and the performance of different assets. But responses to inflation – either in the market (higher interest rates) or via Federal Reserve Bank policy – may also affect inflation.

The different situations of DB participants …

In a (traditional) DB plan, the sponsor holds the asset and interest rate risk. And the decline in interest rates over the last (nearly) 40 years has had a significant negative effect on DB finance and sponsor appetite for the DB design paradigm. We note that that interest rate decline began as a Fed response to late-70s inflation, and that inflation over the last 40 years has remained quite low.

We now have (for 2021 year-to-date at least) the opposite situation – increasing inflation and increasing interest rates.

That has generally been good news for DB sponsors (see October Three’s Pension Finance Update). It has, however, been bad news for many DB participants, because, generally, DB participants hold inflation risk. Their benefit is defined in terms of nominal dollars, and when (as it did in 2021) the real value of a nominal dollar goes down, the real value of their benefit – the goods and services their retirement income can buy – goes down.

(There are exceptions to this effect on DB participants, e.g., a participant in a (traditional) ongoing final average pay plan has considerable inflation protection, with the sponsor bearing that risk.)

All of this explains why, for 2021, traditional DB plan participants, and especially those living on fixed annuity benefits (e.g., the typical retiree or terminated vested participant) and those with frozen annuity benefits, lost ground in 2021, as the chart above indicates.

And DC participants

In a DC plan, by contrast, the DC participant holds all risk – asset performance, interest rate (e.g., the cost of annuitization), and inflation risk. Thus, for DC participants, as noted, decreases in real buying power from increased inflation were more than offset by gains from increases in interest rates and stock markets.

We note that to the extent that increased interest rates reflect an increase in expected inflation, DC participants will have an ongoing challenge – compensating (perhaps through asset allocation strategies) for an expected future decrease in buying power.

Takeaways

Sponsors of DC plans may want to consider which funds in their fund menu provide a hedge against inflation losses and provide investment education with respect to inflation risk.

Raising the issue of inflation in connection with retirement income communications may be more problematic, given that such communications will be subject to DOL-directed format and content beginning in 2022.

Sponsors of traditional DB plans that also sponsor DC plans may want to consider providing communications about the inflation risk to participants’ DB annuity benefit and the possibility of considering that risk when participants make DC asset allocation decisions.

There is widespread discussion about whether 2021 inflation is “transitory” or may be “persistent.” If it persists, it will create a headwind for future retirement finance generally.

* * *

In a follow on article we are going to provide a more detailed analysis of the data underlying the forgoing analysis, with a particular focus on the effect of inflation on interest rates.

We will continue to follow this issue.