September 2017 Pension Finance Update

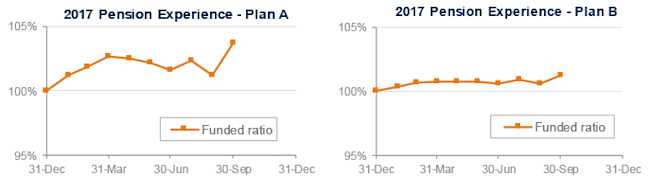

Pensions enjoyed their best month of the year in September, driven by the salutary combination of strong stock markets and rising interest rates. Both model plans we track1 saw improvements last month – traditional Plan A improved more than 2% and is now up more than 3% for the year, while the more conservative Plan B gained close to 1% in September and is now ahead more than 1% through the first three quarters of 2017.

Assets

Stocks enjoyed another strong month in September in what is shaping up to be a very solid year for the stock market. The S&P 500 gained 2% last month, the NASDAQ added 1% and the overseas EAFE index was up more than 2%; but the real star was the small cap Russell 2000, which gained more than 6% in September. Through the first three quarters of 2017, the Russell 2000 is ahead 11%, the S&P 500 is up 14%, and both the NASDAQ and EAFE index have gained more than 20%.

A diversified stock portfolio gained more than 2% during September and is now up 16% through the first three quarters of 2017.

Bonds slipped during September as interest rates moved up across the board, shaving 1% or so off bond values. A diversified bond portfolio has earned 4%-6% so far during 2017, with longer duration bonds and corporates doing best.

Overall, our traditional 60/40 portfolio gained more than 1% in September and is now up 10% for the year, while the conservative 20/80 portfolio lost less than 1% last month but is still up more than 6% ahead during 2017.

Liabilities

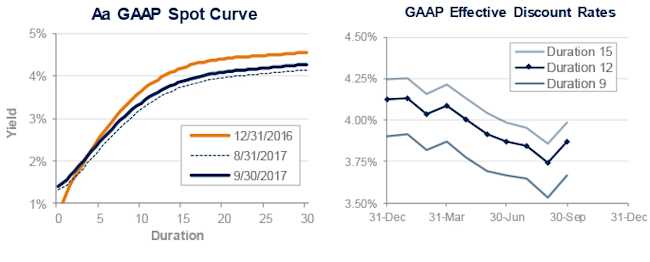

Pension liabilities (for funding, accounting, and de-risking purposes) are now driven by market interest rates. The graph on the left compares our Aa GAAP spot yield curve at December 31, 2016, and September 30, 2017, and it also shows the movement in the curve last month. The graph on the right shows our estimate of movements in effective GAAP discount rates for pension obligations of various durations during 2017:

Yields moved up 0.15% during September, ending a 5-month streak of lower rates and providing welcome relief to pension sponsors.

The move pushed pension liabilities down 1%-2% in September, leaving liabilities about 5%-7% higher during 2017, with long duration plans seeing the biggest increases.

Summary

Through three quarters, 2017 is shaping up to be the best year for pension sponsors since 2013, with asset growth outstripping liability growth for most plans.

The graphs below show the movement of assets and liabilities for our two model plans during the first three quarters of 2017:

Looking Ahead

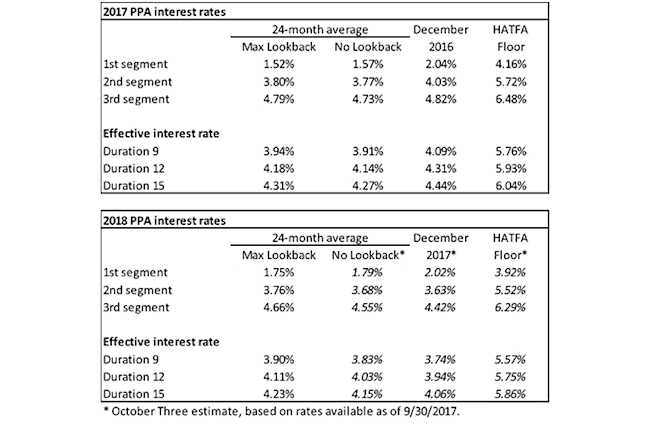

Congress passed a budget in 2015 that includes a third round of pension funding relief since 2012. The upshot is that pension funding requirements over the next several years will not be appreciably affected by current low interest rates (unless these rates persist). Required contributions for the next few years will be lower and more stable than under prior law.

Discount rates moved down a couple basis points last month. We expect most pension sponsors will use effective discount rates in the 3.6%-4.1% range to measure pension liabilities right now.

The table below summarizes rates that plan sponsors are required to use for IRS funding purposes for 2017, along with estimates for 2018. Pre-relief, both 24-month averages and December ‘spot’ rates, which are still required for some calculations, such as PBGC premiums, are also included.

1Plan A is a traditional plan (duration 12 at 5.5%) with a 60/40 asset allocation, while Plan B is a cash balance plan (duration 9 at 5.5%) with a 20/80 allocation with a greater emphasis on corporate and long-duration bonds. We assume overhead expenses of 1% of plan assets per year, and we assume the plans are 100% funded at the beginning of the year and ignore benefit accruals, contributions, and benefit payments in order to isolate the financial performance of plan assets versus liabilities.