Should I borrow money to fund up my pension plan?

In 2015, the Pension Benefit Guaranty Corporation variable rate premium will increase to $18 per $1,000 of unfunded vested liability. In effect, the variable premium will be a 1.8% per year charge for “underfunding.” A sponsor can avoid that charge by, e.g., borrowing an amount sufficient to fund the defined benefit plan’s unfunded vested benefits (UVB). What is the tradeoff — at what interest rate (and rate of return and other variables) does it become financially ‘worth it’ to borrow and fund rather than continue to pay the PBGC variable premium?

In this article we address that question: which is more efficient — funding over 7 years and paying the PBGC variable premium or borrowing and funding immediately? Our purpose is to identify the key variables — PBGC variable premium rate, rate of return on assets, etc. — and to provide a sense of the dynamics, that is, how those variables interact. We will work through an example, with some variations. Obviously, every sponsor’s situation will be different — with different access to credit markets, costs of borrowing, opportunity costs, assumed rate of return, etc. The purpose of this article is simply to give sponsors a feel for the tradeoffs.

Key variables

Here, as we see it, are the key variables that must be considered when determining the relative cost of funding over 7 years and paying the PBGC variable premium vs. borrowing and funding immediately.

PBGC variable premium rate. For purposes of this article, we will consider both the current rate of $9 per $1,000 UVB and the 2015 rate of $18 per $1,000 of UVB.

Cost of borrowing. This rate will determine the relative cost of borrowing-and-funding; it will vary from sponsor to sponsor; and it is probably the most important variable in the analysis. In this article, the cost of borrowing will define the breakeven point — when it is more efficient to borrow and fund immediately rather than fund over 7 years and pay PBGC premiums on the plan’s UVB.

Rate of return on assets. Probably the fundamental difference between paying the PBGC variable premium and borrowing-and-funding is that when you borrow you have assets (the loan principal) that, after they have been contributed to the plan, will be earning a return. Throughout this article we are going to assume a return on plan assets of 4%.

Plan discount rate. Each year, the value of plan liabilities will grow at the plan discount rate. For purposes of this article we are going to assume that the plan discount rate is the same as the rate of return on assets. We believe this approach, an assumed earnings rate equal to the assumed rate of return, is appropriate. Assuming a higher rate of return requires a ‘risky’ portfolio, adding another variable to the analysis.

Base case

In our base case, we are going to assume that the two key variables — cost of borrowing and rate of return on plan assets — are identical. Let’s consider the relative costs of funding over 7 years and paying the PBGC variable premium vs. borrowing and funding immediately.

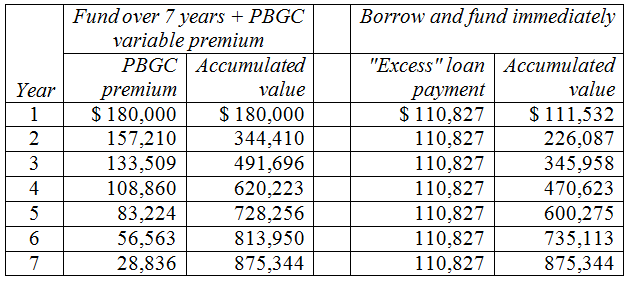

Table 1: Fund over 7 years + PBGC variable premium vs. borrow and fund immediately

_Assumptions:_Assets = $80 millionLiabilities = $100 millionUVB = $20 millionPBGC variable premium rate = $9 per $1,000Rate of return on assets = 4%Cost of borrowing = 4%

Method: Contributions are assumed to go in at the beginning of the year; to preserve comparability, the loan payment is also assumed to be made at the beginning of the year based on a “mortgage-style” level payment schedule. The variable premium is based on UVB as of the end of the prior year; for instance, in year 1 UVB = $20,000,000, and the ($9 per $1,000) variable premium is $180,000.

This example illustrates the fundamental difference between funding over 7 years and paying PBGC premiums, on the one hand, and borrowing and funding immediately, on the other. This example is “easy” because identical payments are made ($3,204,031), in one case to fund the plan, in the other to repay the loan. In both cases the plan is fully funded after 7 years. The only difference: when the sponsor funds over 7 years, it also must pay PBGC premiums.

Thus, where the cost of borrowing and the rate of return on plan assets are the same, it is always “cheaper” to borrow and fund than to fund over 7 years and pay PBGC premiums.

The breakeven point

The next question is, then, how much higher must the cost of borrowing be in order to make funding over 7 years cheaper than borrowing and funding immediately? To determine the answer to this question, we have to compare the relative cost of, on the one hand, the PBGC variable premiums and, on the other, the ‘excess’ loan payments. Excess loan payments are the additional cost of repaying the loan (relative to funding the plan over 7 years) because the cost of borrowing is higher than the rate of return on assets (which, as discussed above, is also our assumed plan discount rate).

To get these two numbers on an ‘apples to apples’ basis, we consider the future value, after 7 years, of each. Thus, we credit interest (at the rate of return on assets) on both the PBGC variable premiums and the excess loan payments.

Holding the rate of return on assets constant, and using the current PBGC variable premium rate of $9 per $1,000 in UVB, the breakeven point is a cost of borrowing of 5.26%. At a cost of borrowing of 5.26%, the annual payment on the loan increases to $3,314,858, $110,827 more than the $3,204,031 annual cost to fund the plan.

Table 2: Relative cost of funding over 7 years + PBGC variable premium vs. borrowing and funding immediately; PBGC variable premium $9 per $1,000; 5.26% cost of borrowing; 4% rate of return

Shortfall = $20 million7 year shortfall amortization (at 4%) = $3,204,031Loan repayment (at 5.26%) = $3,314,858“Excess” loan payment = $110,827

Thus, under current rules (and assuming a 4% rate of return/discount rate), where the cost of borrowing is 5.26% percent or lower, it is cheaper to borrow and fund up than to pay the PBGC variable premiums.

Effect of increase in variable premium

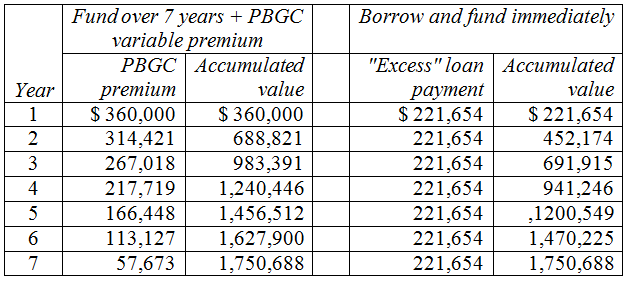

The PBGC variable premium is increasing $4 in 2014 and another $5 in 2015, to a rate of $18 per $1,000. Let’s consider how this increase changes the breakeven point. (We note that the variable premium will be indexed for inflation after 2015 and that there is a “ceiling” on the total amount of variable premium for certain plans; we are ignoring these two nuances.)

Holding the rate of return constant at 4%, at a variable premium rate of $18 per $1,000, the breakeven point increases to 6.52%. That is, if the sponsor’s borrowing rate is lower than 6.52%, it is cheaper to borrow and fund than to fund over 7 years and pay PBGC variable premiums in the meantime.

Table 3: Relative cost of funding over 7 years + PBGC variable premium vs. borrowing and funding immediately; PBGC variable premium of $18 per $1,000; cost of borrowing = 6.52%; rate of return = 4%

Shortfall = $20 million7 year shortfall amortization (at 4%) = $3,204,031Loan repayment (at 6.52%) = $3,425,685“Excess” loan payment = $221,654

On these assumptions, the increase in the variable premium from $9 to $18 per $1,000 increases the ‘effective borrowing rate’ charged by the PBGC on pension underfunding by 1.25%. Thus, under the higher variable premium rate, the borrowing and funding option becomes considerably more attractive.

Interest rates and cost of borrowing generally

Corporate bond yields are currently at or near historic lows, ranging from 3.5%-4.5% for ‘investment grade’ securities. Using those yields to determine whether borrowing and funding immediately makes sense is only part of the story, though — issues such as security and bankruptcy seniority cloud any attempt at an ‘apples-to-apples’ comparison. Moreover, each sponsor’s “cost of borrowing” is unique, and each sponsor will face its own unique set of credit issues and will have its own way of viewing borrowing decisions. But, if interest rates remain low as the PBGC variable premium goes up (in 2014 and 2015), more sponsors will find the prospect of borrowing and funding immediately attractive relative to 7 year amortization + paying PBGC premiums.

Rate of return on assets and plan valuation rate

To keep the above analysis as simple as possible, we have made the rate of return on assets and plan discount rate identical and held it constant at 4%. Those assumptions are realistic assuming a conservative (“LDI-like”) investment strategy. A less conservative investment strategy may make a borrow-and-fund strategy more attractive; if the projected return on plan assets is higher, that (theoretically) reduces the net cost of the loan, but such a strategy adds a dimension of additional risk to the analysis as well.

Tax effects

Generally, the tax effects of the two approaches — funding over 7 years and paying the PBGC variable premium vs. borrowing and funding immediately — net out. That is, assuming constant tax rates, and assuming that both PBGC premiums and interest payments on the loan are deductible, taking the $20,000,000 deduction immediately or over 7 years (with interest) produces the same result after 7 years.

Conclusion

Understanding the PBGC (per capita and variable) premium ‘overhead cost’ on DB plans and the tradeoffs between paying variable premiums and funding is an important element in DB plan finance.

In this article we’ve reviewed some of the variable premium vs. funding dynamics under current rules. It is entirely possible that a further increase in PBGC premiums — perhaps targeting variable premiums — may become part of some ‘grand bargain’ on the budget. As we have said before, because PBGC premiums are booked as revenues, they are an attractive way of improving budget numbers. A further increase in the variable premium would be likely to intensify sponsor focus on the decision between funding over 7 years and paying variable premiums or borrowing and funding immediately.