Society of Actuaries publishes MP-2019 mortality improvement scale and new mortality tables, showing decrements in life expectancy

In October 2019, the Society of Actuaries published (1) a new Mortality Improvement Scale MP-2019 and (2) new base Pri-2012 Mortality Tables. Both MP-2019 and Pri-2012 reflect decrements in age 65 life expectancy which, when adopted by sponsors and regulators, will generally reduce (marginally) defined benefit plan liability valuations. In this article we very briefly review the SOA’s new mortality assumptions and their effect on plan valuations.

Mortality Improvement Scale MP-2019 – lower mortality improvement

On October 23, 2019, the SOA published Mortality Improvement Scale MP-2019, showing mortality improvement rates that are “slightly lower than the corresponding Scale MP-2018 rates.”

This decrement in (assumed) mortality improvement has followed the consistent pattern set by the SOA since it rolled out its new mortality improvement assumptions in Mortality Improvement Scale MP-2014. Those 2014 assumptions were widely criticized as overly optimistic. The SOA has subsequently issued new mortality improvement scales in 2015, 2016, 2017, 2018, and (now) 2019, each of which showed lower mortality improvement than the previous year’s scale.

… and lower DB liability valuations

The decrement (vs. 2018) in mortality improvement under the new Mortality Improvement Scale MP-2019 will result in a reduction in life expectancy assumptions and a (marginal) reduction in DB liability valuations. Quoting the SOA: “most 2019 pension obligations calculated using Scale MP-2019 (with a discount rate of 4.0%) are anticipated to be 0.3% to 1.0% lower relative to their Scale MP-2018 counterparts.”

Pri-2012 Mortality Tables

Also in October 2019, the SOA published new base mortality tables for private sector retirement plans. The new tables are based on a significantly expanded dataset (50% more “life-years of exposure” and 50% more deaths) than prior table RP-2006. (We note that, to confuse things further, RP-2006 had previously been called “RP-2014” but that (quoting the SOA) “[i]n 2018, RPEC [the Retirement Plans Experience Committee] released the RP-2006 Mortality Tables (SOA 2018), which removed the mortality improvement for the years 2007–2014 from the RP-2014 tables, moving their effective date back to the study’s central year, 2006.”)

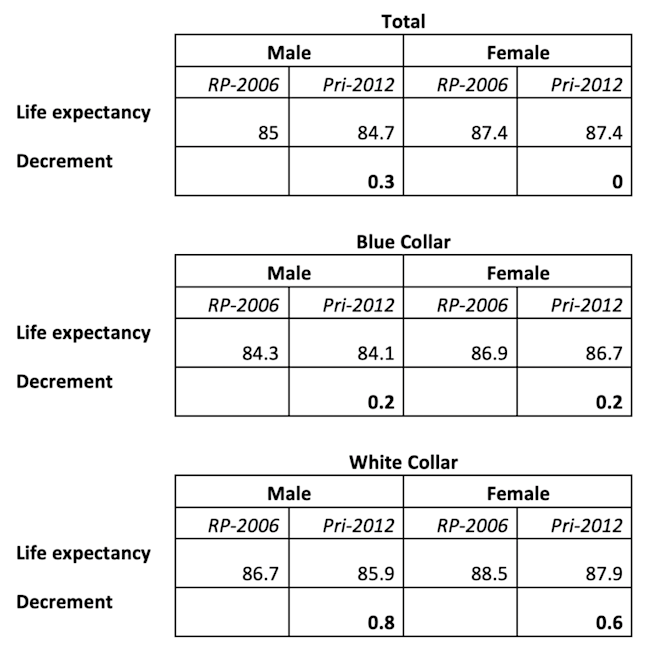

These new Pri-2012 tables (with a “central year” of 2012) also reflect shorter life expectancies than the earlier (RP-2006) tables, as follows:

Table 1: changes in age 65 life expectancy in 2019 Pri-2012 vs. RP-2006

Source: Overview: Pri-2012 Private Retirement Plans Mortality Tables, Society of Actuaries (October 2019)

Interestingly, on this new data, the largest reductions in life expectancy are amongst white collar participants.

How will IRS amend current ERISA DB valuation mortality assumptions?

In 2017 IRS adopted final regulations specifying mortality tables and mortality improvement assumptions to be used for determining the present value of benefits under DB plans for purposes of: (1) ERISA minimum funding requirements; (2) Pension Benefit Guaranty Corporation variable-rate premiums; and (3) lump sum valuations. Those regulations adopted, as the base table, the SOA’s RP-2006.

In the preamble to the final regulation, IRS said that “to minimize the discontinuities in mortality rates that could arise from infrequent updates, Treasury and the IRS contemplate that generally the [mortality improvement] rates will be updated annually.”

In March 2019, IRS issued Notice 2019-26, adopting Mortality Improvement Scale MP-2018 rates (which as noted above, were slightly higher than the new Mortality Improvement Scale MP-2019 rates), for valuations in 2020.

IRS has itself been criticized for its adoption of the SOA mortality improvement assumptions.

We would expect that at some point in 2020 IRS will issue new guidance reflecting one or both of the SOA’s Mortality Improvement Scale MP-2019 and the new Pri-2012 base mortality tables. Exactly how that new guidance will reflect the SOA’s new tables is unclear, although it is likely that it will at least marginally increase expected mortality assumptions, thereby (marginally) lowering valuations.

For sponsors …

Sponsors will want to consult with their actuaries about the effect of the new SOA mortality tables/improvement scale on their plan valuation. The new tables/improvement scale may affect valuations for financial disclosure more or less immediately. The effect on ERISA-related valuations – for minimum funding, PBGC variable-rate premiums, and lump sums – may be (perhaps considerably) delayed.

* * *

We will continue to follow this issue.