Senator Hatch introduces legislation reforming retirement savings rules

Senator Hatch (R-UT) has introduced legislation, the “Secure Annuities for Employee Retirement Act of 2013” (“SAFE”), that includes a number of changes to current retirement plan rules. Most of the changes would affect account based plans (such as 401(k) and other defined contribution plans) and IRAs.

In this article we review some key provisions of SAFE, generally focusing on the changes that will be significant for corporate plan sponsors.

Sweeping electronic notification provision

Probably the biggest ‘news’ in SAFE is a comprehensive rule for the electronic delivery of notices required under ERISA and the Tax Code. The SAFE proposal is very simple. Generally, any tax qualified or ERISA retirement plan document that is required or permitted to be furnished to a participant may be furnished in electronic form if the system for furnishing such a document is designed to result in access to the document by the participant through electronic means and protects the confidentiality of personal information relating to such participant’s accounts and benefits.

Delivery can be by:

Direct delivery of material to an electronic address (e.g., e-mail).

Posting of material to a website to which access has been granted, but only if notice has been provided (furnished by other electronic means if the content of the notice conveys the need to take action to access the posted material).

Or other electronic means reasonably calculated to ensure actual receipt of the material.

Electronic delivery cannot be used if the participant has elected to receive a paper version of such document. A notice must be provided to each participant, in electronic or non-electronic form, before a document is furnished electronically, that apprises him or her of the right to elect to receive a paper version. (Clarification of this ‘pre-notice notice’ requirement may be needed.)

Finally, the electronically furnished document must be prepared and furnished in a manner that is consistent with the style, format, and content requirements applicable to the particular document and must include a notice that apprises the individual of the significance of the document when it is not otherwise reasonably evident as transmitted.

The rules outlined in this proposal are both simpler and easier to use than current Tax Code and (especially) Department of Labor electronic disclosure rules. The comprehensive bill introduced in the House by Congressman Neal (D-MA) in May 2013 did not include any electronic disclosure provision.

Simplified fiduciary rule for selection of annuity provider in a DC plan

Another significant provision of SAFE provides that, where an annuity provider is being selected for the provision of annuity payouts from a DC plan, the plan fiduciary would be treated as having satisfied his or her duty to determine the ability of the annuity provider to make all payments due under the contract “to the extent that such payments are guaranteed by a State guaranty association under applicable State law in effect as of the date of issuance of the contract.”

If such a provision were ultimately adopted, it would go a long way to solving the DC plan ‘annuity fiduciary problem’ – briefly, if the annuity is to be provided ‘inside’ the DC plan (as opposed to being bought by the participant post-distribution, outside the plan), the selection of the annuity provider would be a fiduciary ‘act’ creating some risk to the sponsor (e.g., if the insurance company winds up in insolvency and cannot pay the annuity). This problem is thought to be a significant obstacle to sponsor adoption of an in-plan annuity option.

Easing of RMD rules

SAFE would exempt from Tax Code section 401(a)(9) required minimum distribution (RMD) rules a “qualified deferred annuity” purchased with up to 25% of the participant’s account. A qualified deferred annuity is a commercial annuity for the life of the participant or the participant and his or her spouse under which payments begin no later than age 85. This provision is considerably more generous than Treasury’s proposal, which would limit the value of a deferred annuity to the lesser of 25% of the participant’s account or $100,000.

SAFE would also require IRS to update (within one year of enactment and regularly thereafter) the mortality tables used to determine required minimum distributions. This would ease RMD requirements — as individuals live longer, the period over which RMDs must be made increases and any given year’s RMD goes down.

Finally, SAFE would allow a participant to satisfy a required minimum distribution by converting it to a Roth amount in a plan or IRA. As the related summary of the bill explains, this will “generat[e] a taxable payment but preserv[e] the value inside the retirement account until the participant needs the income.”

Easing of hardship withdrawal rules

SAFE includes rules that would make it easier for participants to take hardship withdrawals from a 401(k) plan.

A participant could take a hardship withdrawal of 401(k) contributions, qualified matching contributions, qualified non-elective contributions and earnings; hardship withdrawals are currently limited to 401(k) contributions only.

A participant would not (as under current rules) have to take an available loan.

Treasury could not (as it does under current regulations) condition the determination of whether the participant has a hardship on whether the participant may make contributions after the hardship distribution.

This provision is a little curious; most ‘policy talk’ is about tightening distribution rules to prevent leakage.

Changes to the 401(k) automatic enrollment/automatic increase safe harbor rules and a new safe harbor

We provide a more detailed discussion of the issues with respect to current 401(k) ‘safe harbors’ in our article Congressman Neal reintroduces comprehensive retirement savings legislation. Like Congressman Neal’s bill, SAFE would eliminate the 10% of pay cap on automatic contributions and change the escalation rate – ‘3%,’ ‘4%,’ etc. – to ‘at least 3% (but not greater than 10%),’ ‘at least 4%,’ etc.

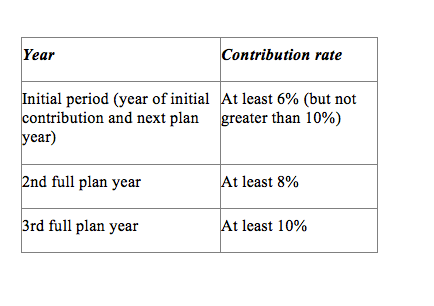

SAFE also would add a new automatic contribution/automatic increase safe harbor that is essentially the same as the one in the Neal bill. It would use higher default contribution rates, as summarized in the following table.

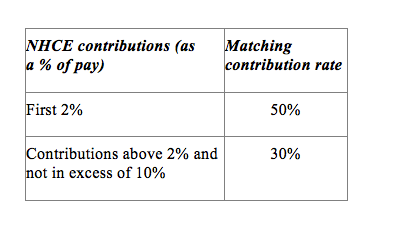

To qualify for the new safe harbor, the sponsor would have to make matching contributions for NHCEs as summarized in the following table.

A rate higher than the 50% or 30% rate may be used, so long as it does not increase as an employee’s rate of contributions increases.

Sole Treasury jurisdiction over IRA prohibited transaction rules; joint DOL-Treasury jurisdiction retirement plan prohibited transaction rules

SAFE would remove jurisdiction over prohibited transaction rules applicable to IRAs from DOL and give it to Treasury. It would also give Treasury joint jurisdiction over prohibited transaction rules for qualified plans (currently DOL has sole jurisdiction), including any regulation that “defines or interprets a term or requirement that is included in [Tax Code or ERISA prohibited transaction rules].”

The SAFE provision would, among other things, give Treasury joint jurisdiction, with DOL, over DOL’s project to redefine the term ‘fiduciary’. DOL originally proposed a regulation re-defining fiduciary in 2010 and, after a lot of controversy, withdrew it in 2011. DOL has said informally that it intends to re-propose this regulation later this year. The SAFE provision would, obviously, limit and likely slow down that project.

Moreover, as we discussed in our article Recent studies on rollovers identify emerging issues, it appears that some (including some at DOL) would like to see ERISA regulation of the rollover process (very much including rollovers to IRAs). There is concern that the re-definition of ‘fiduciary’ would take up that issue, e.g., by making the process by which a participant ‘rolls out’ of an ERISA plan and into an IRA subject to ERISA fiduciary rules. It appears that the SAFE provision may be intended to take jurisdiction over that issue away from DOL and give it to Treasury.

Other provisions

Other provisions of the bill affecting corporate retirement plans include:

Generally repealing Tax Code top-heavy rules.

Allowing a new plan to be adopted by the tax return due date (with extensions).

Allowing a sponsor to elect 401(k) safe harbor status after the beginning of the plan year in certain cases and where an initial 4% matching contribution (as opposed to the ‘regular’ 3% matching contribution) is made.

Making it easier for “designated plan providers” (registered with the Secretary of the Treasury) to ‘sponsor’ multiple employer plans.

Simplification of the plan amendment process.

Allowing the use of forfeitures to fund employer contributions under 401(k) safe harbors.

Simplifying (and to some extent easing) the qualified pre-retirement survivor annuity notice requirements.

Directing DOL to produce regulations allowing benchmarking of funds (e.g., for required participant disclosure) that include multiple asset classes (e.g., balanced funds and target date funds) based on a benchmark that is a blend of different broad-based securities market indices.

Directing DOL and Treasury to adopt regulations allowing the consolidation into a single notice (which itself may be consolidated with the summary plan description) of notices currently required with respect to: a qualified default investment alternative; automatic enrollment; a 401(k) safe harbor; and fee and other information required by ERISA 404(a) disclosure rules.

Expanding the Employee Plans Compliance Resolution System, including self-correction of loan errors, self-correction (without excise tax) of certain inadvertent required minimum distribution errors and establishment of specific correction methods for errors in implementing automatic enrollment and automatic escalation features.

Simplification of the rules for when summary plan descriptions must be delivered and updated.

* * *

Like the Neal bill in the House, it’s unclear whether, in a context of gridlock, this legislation will be moving anytime soon. But some features of it may be included in legislation that is moving.