Annuity Purchase Update – June 2022

Annuity Purchase Update - June 2022

Executive Summary

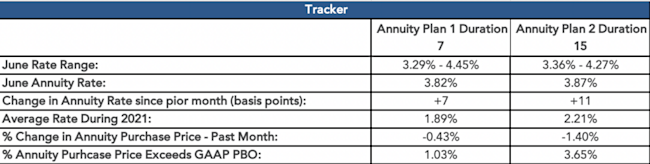

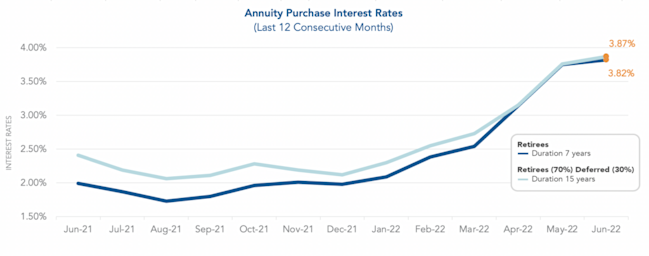

• The average Annuity Purchase Interest rates continue to climb, with the average duration 7 rate at 3.82% and average duration 15 rate at 3.87%.

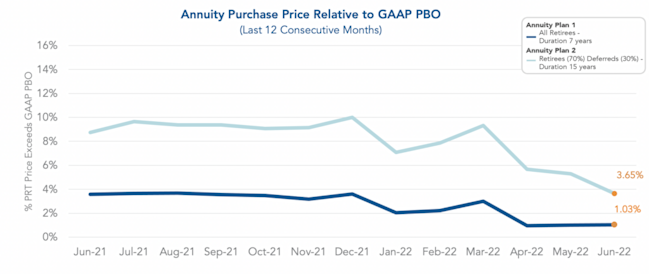

• Annuity Purchase costs relative to pension accounting value (GAAP PBO) are well below our historical averages, suggesting a suitable time for plan sponsors to implement a Pension Risk Transfer strategy for even a subset of the population.

• The cost for Annuity Plan 1* and Annuity Plan 2* has drastically dropped roughly 15% and 25%, respectively, since January 2022.

• Given the upward trend in interest rates and the high volume of placements, it is crucial for plan sponsors to enter the marketplace sooner rather than later to exploit favorable pricing.

• Treasury rates are hitting record highs as current rates are nearly 45 basis points higher than rates as of June 1st.

Narrative

As mentioned in the Pension Finance update, financial markets declined last month, but the net impact on plan funding status was not as substantial. For most plan sponsors, funding status has remained level or improved. High interest rates have offset the effect on pension plans sponsors as. The current average duration 7 annuity purchase rate is at 3.82%, and the average duration 15 rate is 3.87% – a record setting high. Although the market remains volatile, annuity purchase interest rates have been increasing, and inversely annuity purchase costs are declining substantially. In the last 12 months, the average annuity purchase rates have surged over 180 basis points. The Pension Risk Transfer Market is restless, as insurance companies are hitting capacity. To take advantage of aggressive pricing, plan sponsors should prepare for an annuity purchase.

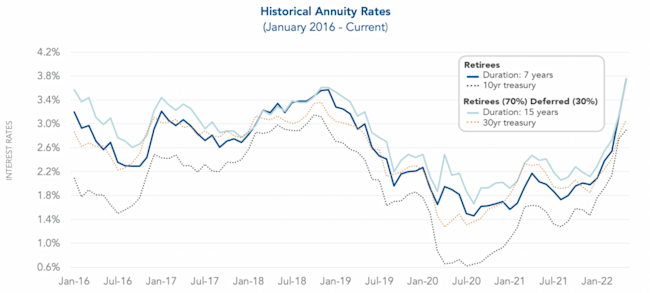

Based on the graph below, it is evident that annuity purchase interest rates and treasury yield rates vary over time, resulting in different peaks and valleys. The 10 year treasury rates are included in the graph as they correlate with the duration 7 annuity purchase interest rates. The 30 year treasury rates correlate with the duration 15 annuity purchase interest rates. Similar to the pattern we observed with the annuity purchase rates, the treasury yield rates have consistently grown year to date. The 10 year treasury rate surged roughly 114 basis points and the 30 year treasury rose about 97 basis points since January 2022. A timely entry into the market place has proven beneficial for plan sponsors to receive favorable pricing. Market activity is at an all time high, so plan sponsors should consider getting their data for a Pension Risk Transfer as early as possible. Implementing a Pension Risk Transfer strategy can help a plan sponsor fulfill organizational goals, including reducing volatility in financial disclosures due to volatile interest rates.

Top 3 ways PRT is lowering plan costs

The graph below represents the difference between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In May 2022, the spread for Annuity Plan 1 slightly increased to 1.00%. Although it widened, the spread is still substantially lower than the historical averages. For Annuity Plan 2, the spread narrowed to 5.30%. This is the lowest we have witnessed in the last 12 months. An increase in annuity purchase rates generally lowers annuity purchase prices relative to accounting book value. Please note, that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

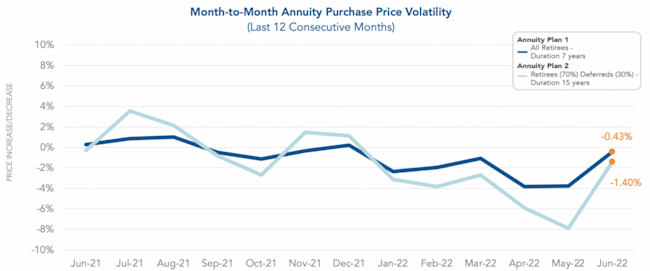

Annuity purchase costs can alter from month to month. Although the market is volatile, we have seen a general downward trend in cost over the last 12 months. Since last month, The purchase price for Annuity Plan 1 decreased by 0.43%, and Annuity Plan 2 dropped 1.40%. An early entrance to the insurance market is a vital component of the planning stage because of the consistent short-term volatility of annuity pricing. Plan sponsors can capitalize on favorable fluctuations in a volatile market by connecting with an annuity search firm early on.

Additional Risk Mitigation Strategies to Consider

Annuity purchases for plan sponsors do not need to occur on an all-or-nothing basis. Many plan sponsors can benefit by purchasing annuities, even for a subset of plan participants. This is especially true for retirees with small benefit amounts. Plan sponsors pay PBGC premiums for participants that do not vary based on the size of the participant’s benefit. For retirees with small benefit amounts, the PBGC premium overhead burden is substantial and can be eliminated through an annuity purchase.

Have a pension risk transfer need but not sure where to start? See our article, What to Look for in An Annuity Search Firm.

October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long-established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed two hypothetical annuity plans, which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 includes 70% retirees and 30% deferred and has a liability duration of 15 years. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.