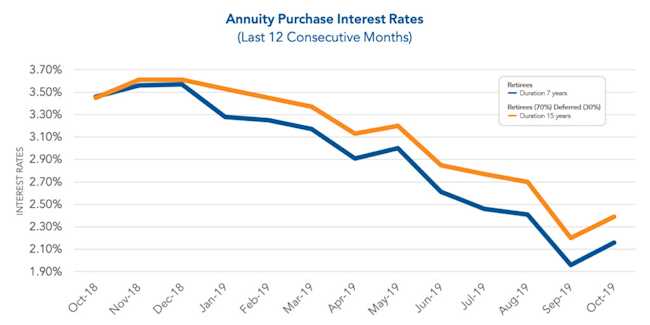

Annuity Purchase Update: October 2019 Interest Rates

October 2019 | |||||

Duration: | 7 Years | 15 Years | 7 Years | 15 Years | |

Range Rate: | 1.99% – 2.35% | 2.19% – 2.59% | Average Rate: | 2.16% | 2.39% |

Although annuity purchase interest rates decreased throughout the year, a jump in rates was observed at the start of the fourth quarter. The activity of plans purchasing annuities remained constant throughout 2019 and has dramatically increased in the beginning of the fourth quarter. Insurance company resources are being utilized to capacity so plan sponsors will need to act quickly if there is intent to take action in 2019. The average duration 7 and duration 15 rates increased by roughly 20 basis points since September 2019. During our experience in 2019, insurers have been aggressively pricing annuity purchases.

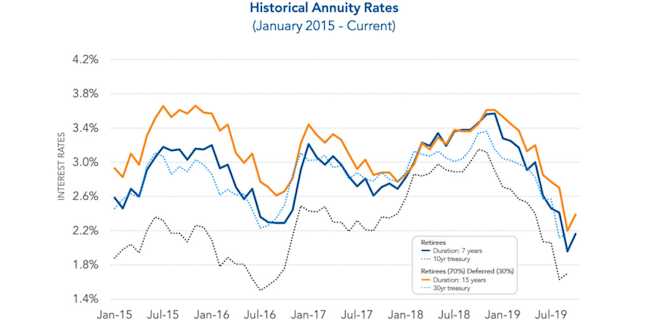

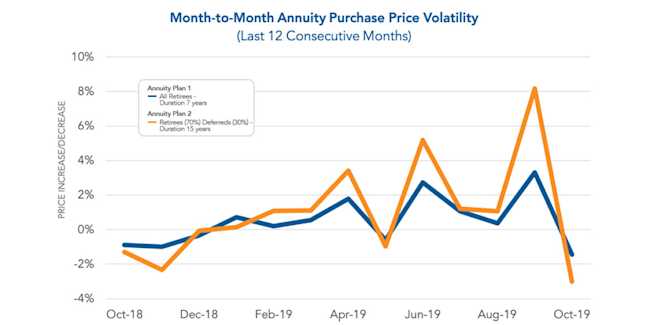

Annuity purchase interest rates fluctuate over time. History demonstrates the volatility of these rates with varying degrees of peaks and valleys. The impact of this volatility can be reduced by implementing Pension Risk Transfer strategies.

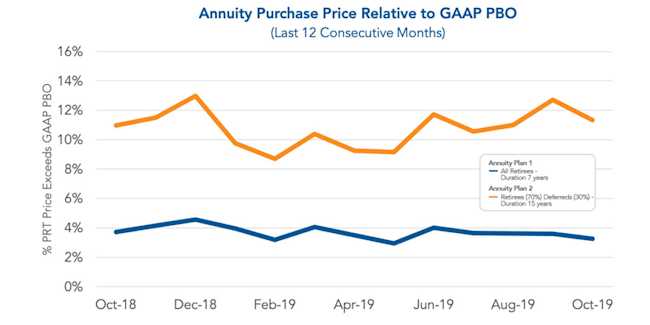

The spread of annuity purchase prices above the GAAP projected benefit obligation (PBO) remained fairly stable during 2018. This spread was around 4% for Annuity Plan 1 and 12% for Annuity Plan 2. When annuity purchase interest rates and yield curve interest rates changed rapidly from December 2018 to October 2019, the spread fluctuated slightly up and down for both plans. A narrow spread may represent an opportunity to settle an annuity purchase at a relatively cheaper price compared to a broad spread.

Keep in mind that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

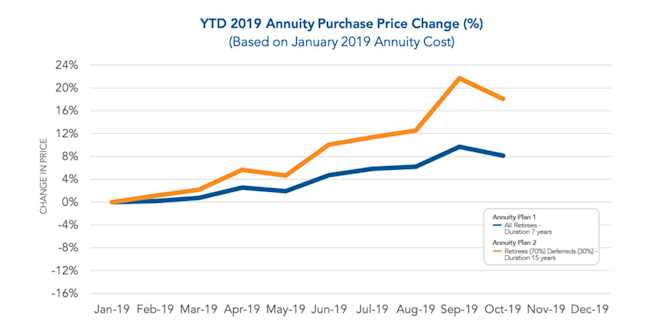

This past year, a significant month-to-month cost volatility has persisted. Timing an early entrance to the insurance market is a crucial part of the planning stage because of the consistent short-term volatility of annuity pricing. Sponsors can take advantage of favorable fluctuations in a volatile market by connecting with an annuity search firm early.

Have a pension risk transfer need but not sure where to start? See our article, What to Look For in an Annuity Search Firm.

*October Three collects annuity purchase rates for Duration 7 years and Duration 15 years from several insurers on a monthly basis. We have constructed 2 hypothetical annuity plans. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual 2018 Pension Risk Transfer market activity and the corresponding impact on pension plans.