August 2023 Annuity Purchase Update

Fitch’s downgraded rating of US Debt triggers a rapid 25 basis point increase in interest rates.

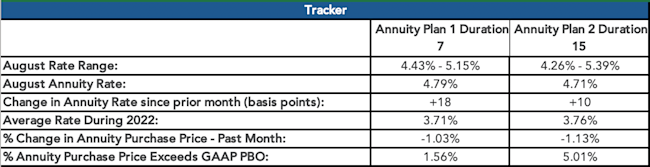

Average annuity purchase interest rates remained stable since last month, decreasing 1 basis point for the duration 7 rate and increasing 4 basis points for duration 15 rate.

2023 is expected to reach a historic peak in the number of annuity transactions.

Consistent Annuity Purchase Interest Rates and improved Pension funding suggest a favorable time to enter the pension risk transfer marketplace.

Insurance providers have already expressed capacity limitations for the fourth quarter. In anticipation of the upcoming PRT market surge, plan sponsors should act now to secure a spot in 2023.

This month, interest rates have surged 25 basis points due to Fitch's downgrade of US debt.

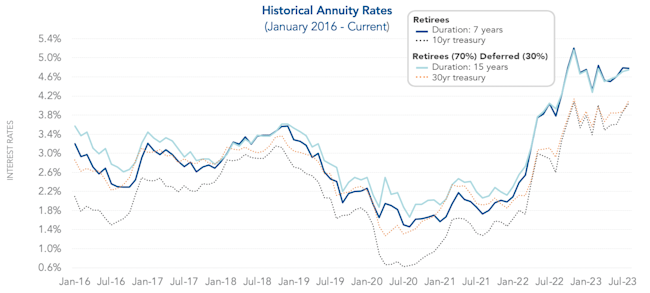

Bustling market activity of the first half of the year carried into the third quarter. Attractive annuity purchase interest rates and improved funding status are driving plan sponsors to de-risk. As of August 1st, average annuity purchase interest rates remained stable since last month, decreasing 1 basis point for the duration 7 rate and increasing 4 basis points for the duration 15 rate. Since then, Fitch's downgrade of US debt drove interest rates to soar 25 basis points. In the last twelve months, the average duration 7 annuity rate increased by 100 basis points, while the average duration 15 annuity rate increased by 80 basis points. As noted in the Pension Finance Update, strong stock market returns and increased interest rates improved pension funding status. Attractive annuity purchase interest rates and improved funding status are driving plan sponsors to settle all or a portion of their pension liability. Insurance companies have noted an increased demand in annuity inquiries this year. There are no indications of marketplace activity slowing down for the rest of the year. It is encouraged to connect with a plan sponsor to enter the marketplace sooner rather than later to lock down favorable rates in this active market.

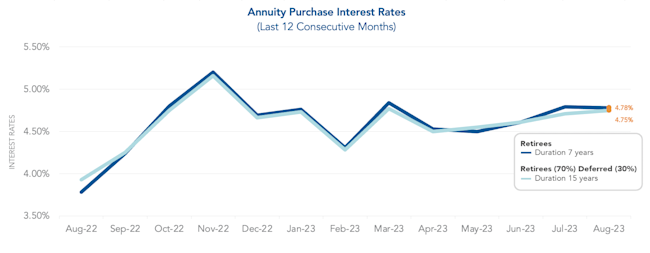

Annuity purchase interest rates moved slightly this past month, with the average Duration 7 annuity purchase interest rate at 4.78% and the average Duration 15 annuity purchase interest rate at 4.75%. The spread between the 10-year treasury rate and 30-year treasury rate widened, placing the two rates 6 basis points apart. As of the beginning of August, the 10-year treasury rate increased to 4.05% and 30-year treasury rate bumped to 4.11%. Thanks to favorable interest rates observed in 2023, market activity is booming. Insurers are experiencing capacity constraints given the volume of placements. Entering the marketplace in a timely manner is important in order to maximize savings.

Top 3 ways PRT is lowering plan costs.

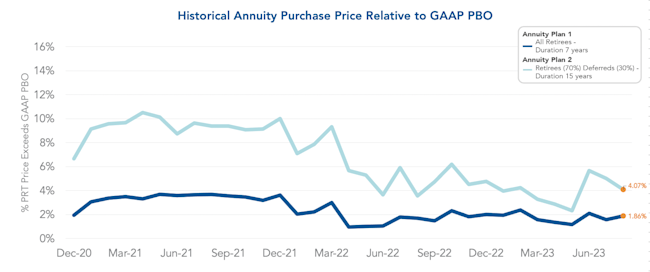

The graph below shows the spread between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In July, we observed the spread between annuity purchase price above GAAP PBO for both plans shift. For Annuity Plan 1, the spread widened to 1.86% and Annuity Plan 2 experienced a consecutive monthly decrease to 4 07%. The current spread for both hypothetical plans are lower than the historical averages. An increase in annuity purchase rates inversely lowers annuity purchase prices relative to accounting book value. Please note that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs.

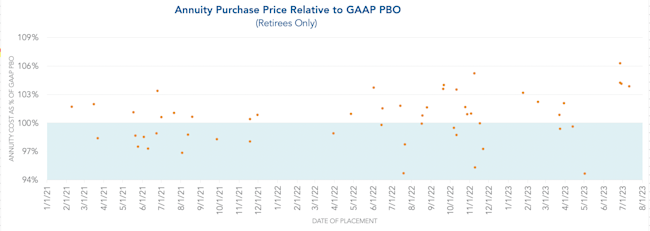

The graph below represents the annuity purchase price relative to GAAP projected benefit obligation (PBO) of the retiree cases placed by October Three Annuity Services since 2021. As we continue into the second half of the year, we will continue to see more placements at October Three. In the first half of 2023, annuity purchase cost for retirees was on average 100.48% of GAAP PBO. Historically, the vast majority of market activity occurred in the third and fourth quarters. This year, insurers have experienced a consistent rush which they anticipate will remain in the second half of the year.

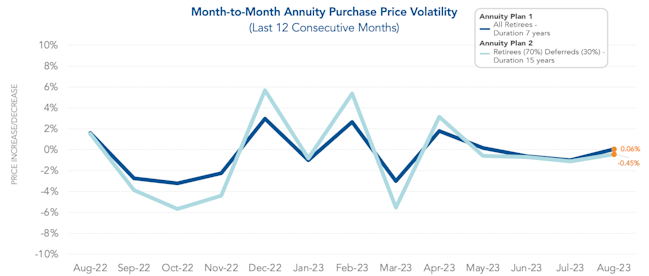

Annuity Purchase interest rates in 2023 have been less volatile than 2022. Thus far in 2023, average annuity purchase interest rates ranged from 4.28%-4.84%. In 2022 the range was 2.09%-5.20%. This month the annuity purchase price increased for Annuity Plan 1 by .06% and decreased for Annuity Plan 2 by .45%. Although the graph below shows a month to month fluctuation, annuity purchase interest rates are market dependent and actually fluctuate daily. To hedge against this short term volatility, a plan sponsor terminating their pension plan could settle the retiree portion of their liability to "lock in" favorable rates.

Additional Risk Mitigation Strategies to Consider

This year is on track to be a record year for the Pension Risk Transfer Market. As pension funding improves and annuity purchase costs become more attractive, the Pension Risk Transfer Market will continue to gain more traction. Annuity purchases do not need to occur on an all-or-nothing basis so to capitalize on favorable market conditions, a plan sponsor should consider purchasing annuities for a subset of the retiree population with small benefits. PBGC premiums for participants do not vary based on the size of the participant's benefit. Purchasing annuities for a subset of the population would guarantee PBGC savings.