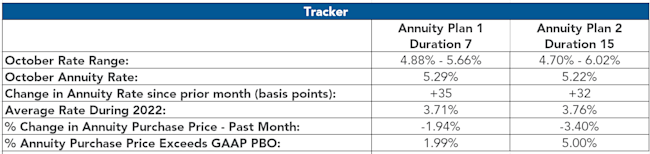

October 2023 Annuity Purchase Update

Average Annuity Purchase interest rates continued to climb reaching the highest observed rates in over a decade.

An all-time peak was reached this year for average annuity purchase interest rates, with the average rate of 5.29% for a 7-year duration and 5.22% for a 15-year duration.

Insurers continue to be selective in opportunities due to capacity constraints so plan sponsors should act immediately to secure a spot in 2023 or early 2024.

Average Annuity Purchase interest rates skyrocketed over 35 basis points in just one month.

Advantageous market conditions are driving plan sponsors to act quickly to achieve their de-risking goals before year-end.

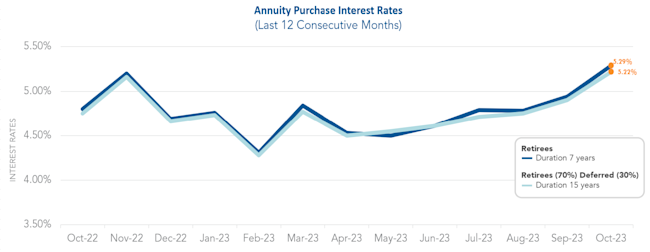

As mentioned in the Pension Finance update, falling stock market returns were offset by high interest rates. Annuity purchase interest rates increased significantly this month, hitting another record for the year. The average duration 7 annuity purchase interest rate peaked at 5.29% and the average duration 15 annuity purchase interest rate rose to 5.22%. These rates represent the highest figures we have ever documented. Since the second quarter of the year, we have observed a steady increase in rates on a month-to-month basis. This constant increase in annuity purchase rates created a favorable environment for de-risking. In the last month alone, the average duration 7 annuity rate increased by 35 basis points, while the average duration 15 annuity rate increased by 32 basis points. The fourth quarter is the busiest time of year for the Pension Risk Transfer Market. It is strongly encouraged to connect with a plan sponsor to enter the marketplace sooner rather than later to lock down favorable rates in this active market.

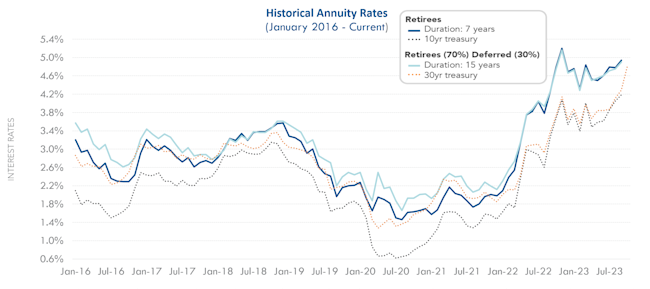

Annuity purchase interest rates and treasury yield rates exhibit fluctuations over time. The 10-year treasury rates are included in the graph as they correlate with the duration 7 annuity purchase interest rates. The 30-year treasury rates correlate with the duration 15 annuity purchase interest rates. Average Annuity Purchase interest rates increased to an all time high this past month. Since last month, both the 10-year treasury rate and 30-year treasury rate jumped over 50 basis points. In 2023, treasury rates and average annuity purchase rates followed an upward trend suggesting an opportune time for plan sponsors to enter the market place.

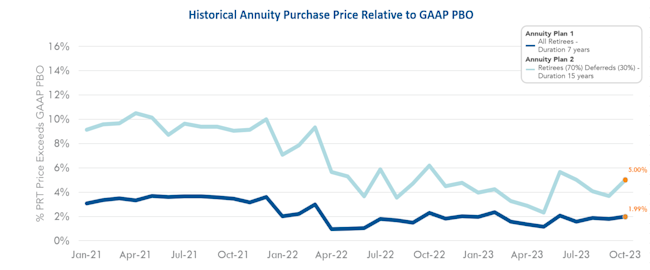

Top 3 ways PRT is lowering plan costs

The graph below shows the spread between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In October, we observed the spread between annuity purchase price above GAAP PBO widen for both plans. For Annuity Plan 1, the spread increased to 1.99% and Annuity Plan 2 shifted to 5.00%. The current spread for both hypothetical plans are lower than the historical averages. An increase in annuity purchase rates inversely lowers annuity purchase prices relative to accounting book value. Please note that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs.

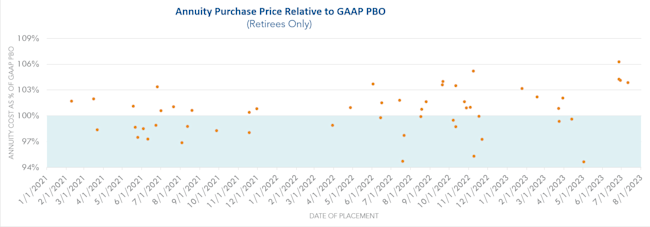

The graph below represents the annuity purchase price relative to GAAP projected benefit obligation (PBO) of the retiree cases placed by October Three Annuity Services since 2021. Since 2021, annuity purchase cost for retirees was on average 100.48% of GAAP PBO. Historically, the vast majority of market activity occurred in the second half of the year. This year, insurers have experienced a consistent rush which they anticipate will remain. Carriers have become more selective in the placements they participate in. To encourage competition and maximize insurance company participation, it is prudent that plan sponsors engage with an annuity search firm sooner rather than later.

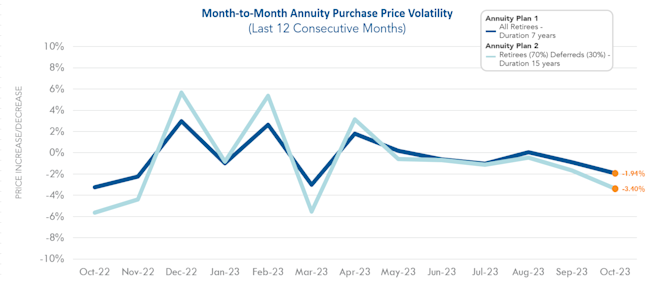

Annuity Purchase interest rates in 2023 have continued their upward trend with steady movement. This month the annuity purchase price decreased for both hypothetical plans. For Annuity Plan 1 the purchase price decreased by 1.94% and for Annuity Plan 2 it decreased by 3.40%. Although the graph below shows a month-to-month fluctuation, annuity purchase interest rates are market dependent and actually fluctuate daily. To hedge against this short term volatility, a plan sponsor terminating their pension plan could settle the retiree portion of their liability to "lock in" favorable rates.

Additional Risk Mitigation Strategies to Consider

This year is on track to be a record year for the Pension Risk Transfer Market. Pension Risk Transfer Market continues to gain more traction as market conditions attract plan sponsors. Favorable market conditions suggest an opportune time for plan sponsors to de-risk. Annuity purchases do not need to occur on an all-or-nothing basis. Plan sponsor could consider purchasing annuities for a subset of the retiree population with small benefits. PBGC premiums for participants do not vary based on the size of the participant's benefit. Purchasing annuities for a subset of the population would decrease headcount and thus guarantee PBGC savings.