How Does a Cash Balance Plan Work?

Cash Balance plans provide significant savings opportunities for partners and owners to maximize retirement savings well beyond the 401(k)/Profit sharing limits.

A cash balance plan is a type of defined benefit retirement plan that provides significant savings opportunities for partners and owners to maximize retirement savings well beyond the 401(k)/Profit sharing limits.But how does a a cash balance plan work and what does it look like for your business? Allow us to explain.

Understanding Cash Balance Plans

A cash balance plan promises to pay a participant a lump sum balance, which consists of contribution credits and interest. Contribution credits are set by the employer in advance and written in the plan’s document. Therefore, they are not discretionary like you might see an employer make inside of a 401(k) plan. Interest crediting is also defined by the plan but is often tied to the underlying investment returns to minimize risk to the plan sponsor and create a promise that behaves similarly to the way a 401(k) plan operates.

How Does a Cash Balance Plan Work?

A cash balance plan (CBP) is a qualified retirement plan expressed as an account balance, similar to a 401(k). It is a defined benefit (DB) plan that has been structured specifically to meet the increased contribution and equity objectives of professional service firms. Unlike a traditional DB plan, a cash balance plan has the look and feel of the firm’s existing defined contribution (DC) plan where each participant has an “account” that grows each year with contribution credits and interest credits.

In addition, there is “equity” among participants in that the cost of each individual’s benefit can be readily identified for cost allocation purposes. Because a cash balance plan is a defined benefit plan, contributions can be much larger. There are also some additional rules. Such plans typically supplement a firm’s existing defined contribution program (401(k)/Profit Sharing) and provide all of the following advantages:

Income deferral opportunities far beyond defined contribution limits

Flexibility around who is covered and the contribution levels

Tax-deductible contributions which protect assets from creditors.

Lump sum payouts available for rollover or Roth Conversion

Transparency regarding the cost of each participant’s benefit

Who is Eligible for a Cash Balance Plan?

Cash balance plan eligibility typically depends on the employer's policies and can vary substantially between companies. Typically eligibility extends to employees who meet the following criteria:

Age 21 or older

Work 1,000+ hours annually

Are not part of a collectively bargained group

Have taxable domestic income

What Are the Contributions to a Cash Balance Plan?

Contributions to a cash balance plan are made by the employer, allowing participants to focus on managing their other retirement assets. Each participant in a cash balance plan has a notional retirement account that receives periodic employer contributions. These specific contributions are sometimes based on a predetermined percentage of their salary, and subsequent investment earnings.

Is a Cash Balance Plan Tax Deductible?

Employer contributions to cash balance plans are tax deductible. Total deductible contributions can be two to four times more than contributions to the firm’s existing qualified defined contribution plan (for 2024, the limit on total contributions to a DC plan is $69,000 if under age 50, and $76,500 if 50 or older). Cash balance plan contributions are in addition to the amounts contributed to the DC plan and typically vary based on a participant’s age, compensation level and/or employment group.

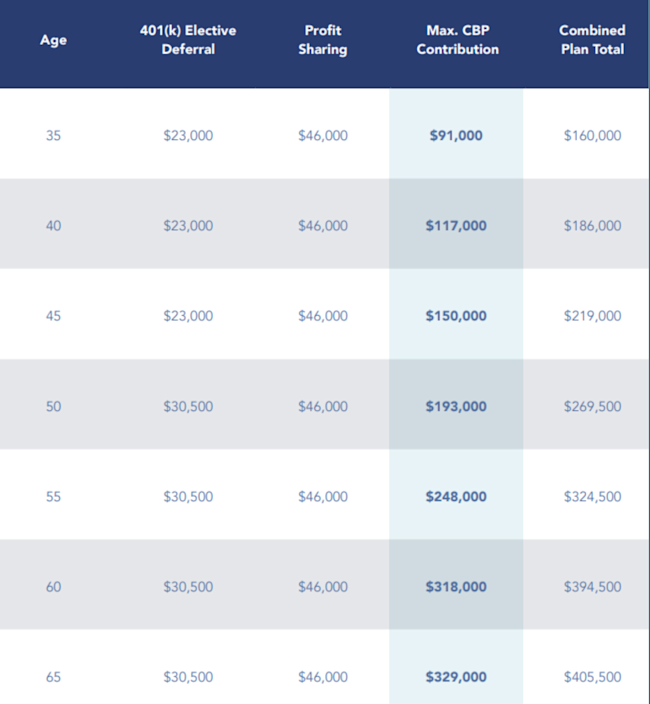

As displayed in the table below, the maximum cash balance plan deferral opportunity increases with age. Coupled with the maximum defined contribution amounts from elective deferrals and profit sharing, the table shows the maximum deductible contribution opportunity available across all qualified retirement plans. While it may be appropriate for some key employees to have contributions at the highest levels, for others it may not. The flexibility built into the overall program is designed to meet the individual needs of each key employee. To see what your contribution could look like try our contribution calculator.

Is There an Added Cost to Cash Balance Plans?

The amount that can be contributed on behalf of business owners or partners is impacted by the level of benefits provided for the staff. In general, contribution levels for staff need to be in the range of 5.0% to 7.5% of pay. Because many companies already provide benefits at this level, there is typically no added cost for establishing a cash balance plan. If the staff contribution is not within the stated range, then adoption of a cash balance plan may require additional funding into a defined contribution contributions.

Final Thoughts

Cash balance plans can optimize the benefits of both defined benefit and defined contribution plans for your business. At October Three, we specialize in creating strategic cash balance and hybrid pension plans designed specifically to maximize the benefits for employers and employees.

Our team is dedicated to helping businesses navigate the complexities of retirement planning and creating unique solutions that work best for their circumstances. Interested in seeing how a cash balance plan might work for you? Try out our contribution calculator to see what you could contribute on an annual basis or request a personalized illustration.

Cash Balance Plan FAQs

Where does the money from a cash balance plan come from?

The money from a cash balance plan comes from contributions made by the employer.

What happens to a cash balance plan if an employee quits?

Cash balance pension plans are portable, meaning that participants can take the vested portion with them if they quit their job and move it into another retirement account.

Is a cash balance plan better than a 401K?

Whether a cash balance plan is better than a 401(k) depends on your individual financial situation, preferences, and retirement goals. Cash balance plans have higher contribution limits, making them a more tax-effective option for high earners. That said, cash balance plans provide significant savings opportunities for partners and owners to maximize retirement savings well beyond the 401(k).

Can a cash balance plan be rolled over?

Yes, if an employee changes their job, their cash balance plan can move with them. If their new employer doesn’t offer a cash balance plan, they can roll it into an IRA.