DB funding: pay now or pay later

It looks like many sponsors that are currently taking advantage of defined benefit plan minimum funding relief will, beginning in the next five years (or so), have to start paying down plan underfunding. In the interim, the primary incentive for plan funding is Pension Benefit Guaranty Corporation variable-rate premiums.In this article we review, first, the likely trajectory of funding relief and when it will begin to phase out. We then consider the cost of delaying funding – the variable-rate premium “tax” on underfunding. We conclude with a review of the “moving parts” of any decision to fund or not fund.

It looks like many sponsors that are currently taking advantage of defined benefit plan minimum funding relief will, beginning in the next five years (or so), have to start paying down plan underfunding. In the interim, the primary incentive for plan funding is Pension Benefit Guaranty Corporation variable-rate premiums.

In this article we review, first, the likely trajectory of funding relief and when it will begin to phase out. We then consider the cost of delaying funding – the variable-rate premium “tax” on underfunding. We conclude with a review of the “moving parts” of any decision to fund or not fund.

Trajectory of funding relief

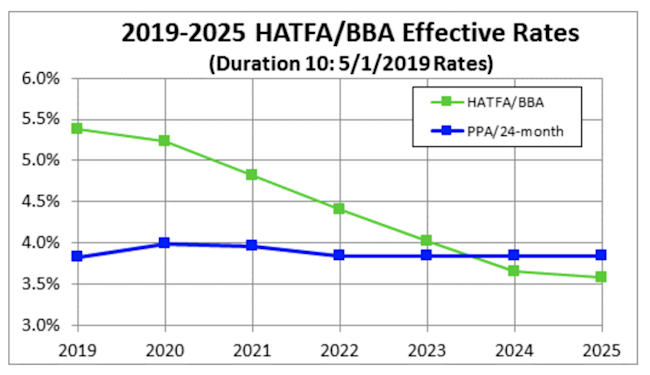

Unlike financial reporting – which generally reflects current market interest rates – the interest rates used to calculate liabilities for funding purposes under ERISA minimum funding rules are subject to a couple of significant “fudges.” Under the Pension Protection Act (PPA) a 24-month average of first, second and third segment rates is generally used to value liabilities. But that rate is subject to a floor: under the Highway and Transportation Funding Act (HATFA), as amended by the Bipartisan Budget Act of 2015 (BBA), oversimplifying somewhat, 90% of a 25-year average of those 24-month rates is used, as a floor on rates, through 2020. Beginning in 2021, the 90% factor “phases down” over the period 2021-2024 to 70%.

As a practical matter, the HATFA/BBA rates are the liability valuation rates for ERISA minimum funding purposes until (at current interest rates) around 2024. The following chart shows valuation interest rates used for calculating liabilities for a duration 10 plan, assuming no change in interest rates after April 2019.

Shadow underfunding

One way to think about what is going on here is that, during the period that HATFA/BBA funding relief is in effect, the plan is carrying a “shadow underfunding” that isn’t currently recognized but will have to be recognized and funded once that funding relief goes away.

On these numbers, funding relief goes away entirely in 2024. Before then, as the chart indicates, funding relief will phase down, and many plans may have to recognize and fund some portion of the “shadow underfunding” prior to 2024.

The significance of PBGC variable-rate premiums

As we have discussed, until funding relief phases out, the primary incentive for a sponsor to fund an underfunded DB plan is the high rate of PBGC variable-rate premiums. These are calculated as a percentage of unfunded vested benefits (UVBs). For this purpose, the value of a plan’s UVBs is calculated based on current (“real”) interest rates, ignoring HATFA/BBA funding relief. Thus, PBGC variable-rate premiums function as a tax on a plan’s actual underfunding. The 2019 variable rate premium is 4.3% of UVBs. The variable-rate premium will increase after 2019 based on the rate of wage inflation. (For purposes of this article we are going to ignore the effect of the variable-rate premium headcount cap.)

Outcomes under alternative funding strategies

The primary way for a sponsor to avoid paying the variable-rate premium “tax” is to fund the plan.

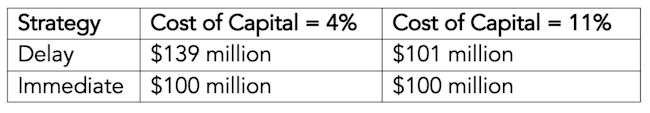

In what follows we consider (in a simplified example) the present value of contributions + variable-rate premiums under two different funding strategies: (1) delay funding as long as possible; and (2) fully fund current plan underfunding in 2019.

We use an example plan with, for 2019, liabilities of $1 billion and assets of $900,000 million, with no ongoing accruals. We assume: (1) the plan’s “real” valuation interest rate (that is, the rate that will apply once HATFA/BBA funding relief did not apply) is 4%; (2) the expected rate of return on plan assets is 4% (we will also consider an alternative earnings rate); and (3) a cost of capital ranging from 4%-11%. We assume PBGC variable-rate premium increases of 0.1% per year over the relevant period, so that, e.g., the variable-rate premium for 2020 will be 4.4%, for 2021 4.5%, etc.

Finally, we assume that, for this plan, HATFA/BBA funding relief phases out, and required PPA minimum funding phases in, over the period 2021-2023, and then PPA minimum funding fully applies starting 2024. Thus, this plan funds a portion of its “shadow underfunding” over the period 2021-2023 and then begins fully funding it starting 2024.

Under the second strategy (“Immediate”) the sponsor funds the entire current “real” shortfall ($100 million) immediately.

With these assumptions, we discount payments under each strategy using two cost of capital alternatives – 4% and 11%.

Table 1

Present value of total cost of funding $100 million of current underfunding under different funding strategies; 4% earnings rate

To be clear: We are comparing the cost of two different funding strategies; thus, a lower cost is better.

The reason it costs more to delay funding is (in these numbers) entirely due to the fact that if the sponsor delays funding it will have to pay the variable-rate premium “tax,” whereas if it funds immediately it will not.

On these assumptions, the break-even cost of capital for delayed funding is pretty high – around 11%. At lower costs of capital it generally is better to “pay now” and avoid paying the PBGC premiums.

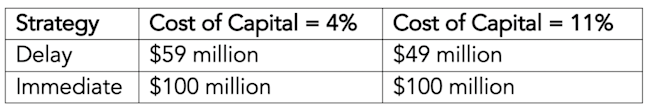

Varying the earnings rate

These numbers are, however, particularly sensitive to changes in the plan’s earnings rate. Here’s the same analysis but assuming a 5% earnings rate.

Table 2

Present value of total cost of funding $100 million of current underfunding under different funding strategies; 5% earnings rate

In this situation – where the earnings rate is higher than the plan’s interest rate – part of the plan’s underfunding is “paid for” out of investment earnings. That, of course, doesn’t happen where the plan’s underfunding is immediately funded in 2019 – in that situation the higher earnings rate produces a (significant) plan surplus. That plan surplus is not accounted for in these (very simplistic) numbers. As we have discussed, a plan surplus can be valuable, but many firms will probably prefer to deploy capital in the enterprise rather than the plan.

Increases in the “real” valuation interest rate (from the current rate of around 4%) will have a similar effect: part of the plan’s underfunding would be “paid for” out of “gains” on the plan’s liability portfolio resulting from interest rate increases.

Finally, we have not considered tax effects. Different firms will have very different tax situations/preferences. For some sponsors contributing to a plan and taking a current deduction may have significant value. For others it will have none.

No easy answer

Bottom line: different strategies work better under different versions of an unpredictable future.

The challenge for the sponsor comes down to a judgment with three moving parts: (1) how “problematic” it is to have capital tied up in a plan (as surplus) instead of deployed in the business; (2) the likelihood that favorable earnings or interest rate increases will make funding unnecessary; and (3) the cost of (avoidable) PBGC premium taxes if the plan is not funded.

* * *

Our purpose has been to illustrate the parameters of a sponsor decision to fund/not-fund – not to provide the “right answer” for any particular sponsor.

Different sponsors will give priority to different variables. For some, the efficient deployment of capital (and, e.g., the cost of capital) will drive the decision. Others will differ over estimates of future earnings or interest rates.

One observation: It’s possible to get a plan surplus back (although not always efficiently), or at least to get credit for it on sponsor financials. You can’t get PBGC premiums back.

We will continue to follow this issue.