Markets 2020 – effect on DC plan participants

As we discussed in our article Interest rates 2019 – the effect of recent declines on DC plans, if we assume (as is generally the case) that the purpose of 401(k) savings is to provide income in retirement, then both gains/losses on the participant’s account balance and increases/declines in interest rates will affect the “funded status” of the participant’s retirement income target.

The effect of asset gains/losses is obvious. The effect of interest rate increase/declines is less intuitive. In effect, interest rate declines represent an increase in the cost of retirement income; interest rate increases represent a decrease in that cost.

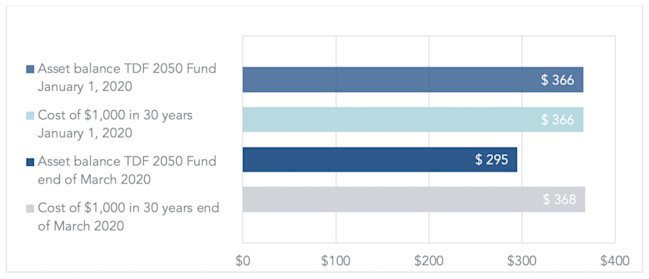

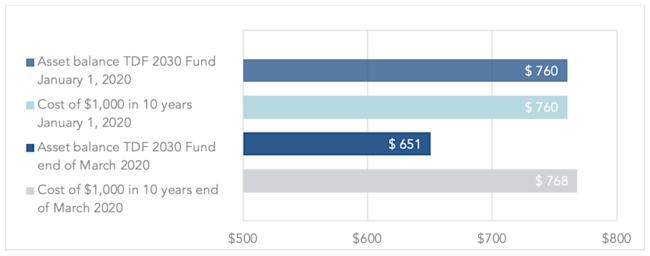

With that background – that what is happening both in the asset and interest rate markets matters to the DC participant’s retirement equation – we are going to, in this article, simply review the effect of the current market turmoil on two example participants: (1) a 35-year old invested in a 2050 target date fund (TDF), and (2) a 55-year old invested in a 2030 target date fund (TDF).

Keeping it very simple, they both have a retirement income goal of $1,000 payable when they reach age 65. At the beginning of the 2020, they had enough to buy a zero-coupon bond payable when they reached age 65 that would pay $1,000.

Here’s what has happened to them thus far this year:

Chart 135-year old invested in 2050 TDF, account balance vs. cost of $1,000 at age 65, as of the beginning of the year and as of 3/31/2020

Chart 255-year old invested in 2030 TDF, account balance vs. cost of $1,000 at age 65, as of the beginning of the year and as of 3/31/2020

For the year, interest rates are (essentially and subject to ongoing volatility) flat. So the losses (against the participant’s retirement goal) are a function of asset returns, which are in turn largely a function of return on equities.

The 55 year old has done marginally better (by about 4.5 percentage points) than the 35 year old.

Unlike 2019 – which saw a nearly 100 basis point decline in rates – and unlike Treasuries – which thus far this year have declined more than 100 basis points – corporate yields are as of the end of March more-or-less flat for the year (although subject to considerable volatility).

Whether the spread between Treasuries and Corporates remains as wide as it currently is, and whether the decline in Treasuries persists, will be things-to-watch as the current crisis unfolds.

We expect to update this analysis more or less monthly, at least as long as markets remain as volatile as they currently are.