Retirement income and inflation – April 2022 update

Retirement income and inflation – April 2022 update Until 2021, the main drivers of retirement finance/retirement income were interest rates and asset performance. The other variable affecting nominal performance, mortality, has been (and is expected to continue to be) relatively stable.

In this article, we update our discussion of retirement income and inflation, which we last reviewed in October 2021.

The impact of inflation on retirement income

Until 2021, the main drivers of retirement finance/retirement income were interest rates and asset performance. The other variable affecting nominal performance, mortality, has been (and is expected to continue to be) relatively stable.

Beginning in 2021, however, inflation has been a significant factor. Obviously (and tautologically), inflation has no effect on nominal performance. And thus, e.g., for defined benefit plan sponsors, who typically exist in a largely or purely nominal world, inflation is generally irrelevant, except to the extent that inflation expectations may affect interest rates (see below).

Increases in CPI directly affect nominal annuity income

Inflation is, however, a real risk to participants receiving retirement income, reducing the buying power of nominal savings and income and, thus, the amount of the retirement consumption – the end purpose of all retirement systems – that a participant can fund.

As we discuss in more detail in our article The effect of inflation on retirement savings/income – conceptual issues – first quarter 2022 update, inflation is most critically an issue for annuitized/annuitizing participants. Increases in inflation (tracked as increases in the Consumer Price Index) reduce the buying power of nominal fixed income benefits, such as a traditional defined benefit plan annuity promise, or an annuity currently being paid out of a DB or DC plan.

For the period January 1, 2021 – to date, the CPI has increased 10%. Practically, that means that a participant who at the beginning of 2021 had an annuity of, say, $1,000 per month and thus could buy $1,000 (in “$2020”) in goods and services can now only buy $900 (in $2020) of good and services.

Expected future inflation affects interest rates

Inflation expectations show up as increases in interest rates. They are tracked as increases in the “breakeven inflation rate,” the difference between rates on nominal Treasury securities and Treasury Inflation-Protected Securities (TIPS).

For the period January 1, 2021 – April 20, 2022, inflation expectations (as measured by the nominal-to-TIPS breakeven inflation rate) have increased by 1.41%, 0.93%, and 0.60% over 5, 10, and 30 year durations, respectively.

What are the effects of these increases in cost of living and inflation outlook?

In DB plans: Inflation does not directly affect sponsor finance, but expected future inflation will increase interest rates, reducing liability valuations. Inflation will also affect stock market and (especially) bond market performance. For participants, increases in the CPI directly reduce the value/buying power of participant/retiree annuities.

In DC plans: Increases in the CPI directly reduce the value of a fixed dollar annuity, making the annuitization decision (when and whether to annuitize) especially consequential and sensitive to inflation volatility/risk. Sponsors considering offering an annuitization option will want to consider communicating to participants about this risk and the possibility of making available counter-inflation investments that may hedge it.

Tracking the effect of inflation on retirement income

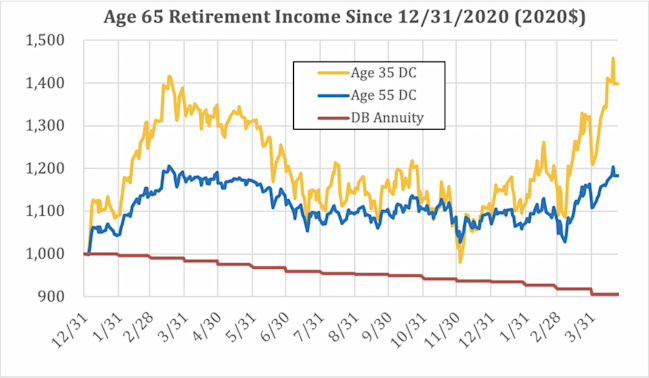

Since 2021 we have been tracking the effect of inflation (together with interest rate and securities market performance) on participants’ retirement income – both in DB and DC plans. Here are numbers for the period January 1, 2021 – April 20, 2022 for our example 35- and 55-year old participants, compared with a DB participant. Numbers are given in $2020, to pick up the effect of inflation on buying power.

The chart makes clear that non-annuitizing DC participants did much better since the end of 2020 than, e.g., a DB participant of any age or a DC participant who annuitized at the beginning of the year.

Interestingly, the improvement in retirement income buying power was not due to asset performance. Over the period, the assets (invested in age-appropriate target date funds) were more or less flat for the 55-year old and improved only 5% for the 35-year old – with the difference due to a higher target date fund allocation to equities/lower allocation to bonds for the 35-year old.

The increase in the non-annuitizing participants’ retirement income buying power over this period is primarily due to increases in interest rates — Treasuries and Aa bonds are broadly up (across all durations) around 150 basis points.

We note, finally, that our retirement income chart only discounts for CPI – that is, inflation that has already happened. If the fundamentals underlying the breakeven inflation rate numbers are realistic, there is more inflation to come, further decreasing the buying power of annuitizing participants.

* * *

For a more detailed discussion of these issues, see our article The effect of inflation on retirement savings/income – conceptual issues ��– first quarter 2022 update.