The Effect Of Inflation On Retirement Savings/Income – Conceptual Issues

We recently published an article analyzing the effect of inflation on retirement income. In this (more technical) article, we discuss, generally and theoretically, the issues increased inflation/inflation risk present for both DB and DC plans.

The discussion is somewhat dense. To keep it as straightforward as possible, we present it in outline form, beginning with the takeaways:

Takeaways for DB sponsors

Increases in the CPI (inflation that has already happened) have no direct effect on defined benefit plan sponsors.

Increases in the CPI will, however, decrease the value (buying power) of participant/retiree annuities.

To the extent expected future inflationincreases interest rates, liability valuations will go down.

Inflation will also affect the stock market and (especially) the bond market, and sponsors will want to consider how these effects interact with the interest rates used to value liabilities and whether they should affect portfolio strategy.

Takeaways for DC sponsors

In a defined contribution plan, all risk, including inflation risk, is held by the participant.

Sponsors will want to consider (1) communicating with participants (“participant education”) about the effects of inflation on asset allocation decisions and retirement income targets and (2) reviewing the fund menu with a view to making inflation hedges available.

Annuitization adds a unique inflation exposure – increases in the CPI directly reduce the value of a fixed dollar annuity.

Sponsors considering offering an annuitization option will want to consider communicating to participants about this risk and (again) the possibility of making available counter-inflation investments that may hedge it.

General framework

1. Inflation is a reduction in the buying power of nominal income (dollars).

2. Inflation that has already occurred, i.e., an increase in the Consumer Price Index (CPI), reduces the value of current income, the amount of goods and services a specified amount of dollar-denominated income can buy. Examples – an increase in the CPI reduces the buying power of the coupon on a bond, a monthly annuity payment, and an individual’s wages.

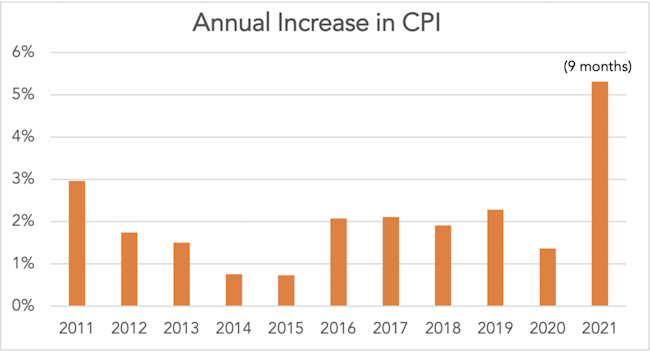

Through September, CPI has increased 5.3% this year.

3. Inflation that is expected in the future is accounted for in interest rates. A creditor trades (nominal) money now for (nominal) money in the future. To the extent that the creditor expects future inflation (an anticipated reduction in the buying power of future (nominal) money), the creditor will naturally build that expectation into the price (interest rate) he demands for credit. In other words, higher inflation expectations = higher interest rates (all else equal).

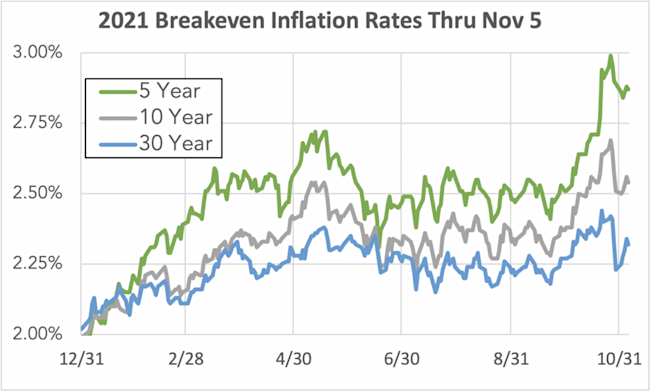

The expected inflation component of nominal interest rates (also known as the “breakeven inflation rate”) can be derived from the spread between the yield on nominal Treasury securities and the yield on related Treasury Inflation-Protected Securities (TIPS), the “TIPS spread.”

The TIPS spread has increased by 0.92%, 0.55%, and 0.30% over 5, 10, and 30 year horizons since the beginning of the year.

(Source: Federal Reserve Bank of St. Louis)

4. One way to think about the relationship of CPI to the TIPS spread is that the TIPS spread represents an estimate of inflation risk; whereas an increase in the CPI represents a sustained loss (to inflation).

5. An inflation-driven increase in interest rates (described in 3) reduces the cost of future income. For instance, at higher interest rates, the cost of annuity income goes down, as does the present value of defined benefit plan liabilities.

6. Only unexpected inflation affects finance. Where future inflation exactly equals expected inflation, that is, where future increases in the CPI exactly equal the TIPS spread, inflation has no effect on finance generally and retirement finance in particular. And all future increases in the CPI would be exactly compensated for by the reduced cost of future income reflected in the TIPS spread.

7. Unexpected inflation does present a real risk to finance/retirement finance. Where inflation exceeds expectations over time, holders of nominal income instruments (bonds and annuities) sustain a real loss. The bond coupon/annuity payment has less buying power than expected. Likewise, where interest rates “overestimate” future inflation, holders of nominal income instruments sustain a real gain.

Retirement finance generally

8. A person saving for retirement faces four risks:

(i) Investment returns. How much she will earn on savings between the current period and the point at which she must turn these savings into retirement income.

(ii) Interest rates. As noted, interest rates define the cost of buying future income. As such, they are the primary driver of, e.g., annuity prices and DB liability valuation.

(iii) Mortality (alternatively, “longevity risk”). Mortality/life expectancy defines how long retirement income must be paid for.

(iv) Inflation. Risks (i)-(iii) generally determine the nominal amount of a participant’s retirement income. Inflation (specifically, higher-than-expected-inflation) represents a risk to the buying power of that nominal income.

Inflation and DB plans

9. In a defined benefit plan, the employer/sponsor holds risks (i)-(iii) but does not hold risk (iv) (other than for ongoing final average pay designs). As a result:

Because (generally) the sponsor’s DB plan liabilities are stated in terms of nominal future income, sponsors “do not care” about CPI.

Anticipated future inflation, reflected in the TIPS spread/higher interest rates, reduces sponsor cost because it reduces the cost of nominal income.

10. In a DB plan, the participant holds a “naked” nominal income claim. And inflation (expected and unexpected) reduces the value (the buying power) of that claim.

11. In this situation, there is no “unexpected inflation risk” – in the sense of a possible mismatch between expected and actual inflation. Instead, higher inflation is “always good” for sponsors and “always bad” for participants.

12. DB participants can, however, hedge against the risk of higher inflation by buying (outside the DB plan) inflation-hedging assets (e.g., real estate). And sponsors can hedge against inflation going lower (and increasing plan costs) by using liability-driven investment strategies.

Inflation in DC plans

13. In a DC plan, participants hold all risks (i)-(iv). Risk (iv), however, remains “open” until the point at which the participant annuitizes.

14. If (as often happens), the participant never annuitizes, then the participant is not exposed to the loss-of-nominal-income risk that results from an increase in the CPI. He is, however, exposed to a variety of inflation-related market effects, most obviously the effect of increases in inflation/inflation expectations on the bond market.

15. Direct inflation risk is triggered by a conversion of a participant’s account to (nominal) retirement income (e.g., via annuitization). In that situation, as long as actual inflation (CPI) is less than expected inflation (the TIPS spread), the participant is better off annuitizing. Where actual inflation exceeds expectations, the participant is worse off.

16. With regard to DC participant inflation risk, 2021 is particularly instructive:

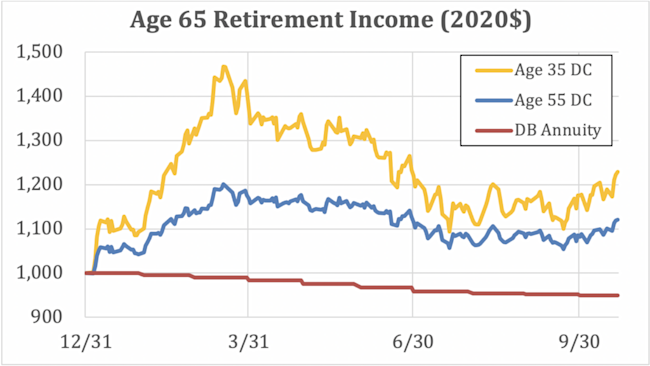

We track the projected age 65 retirement income of two example DC participants invested in a standard (age-appropriate) target-date fund. Each participant, as of the beginning of the year, would have been able to buy a $1,000 per month annuity with her account balance. Here’s the chart for mid-October 2021, adjusted for inflation (these numbers are in “2020 dollars”), with the “performance” of a DB annuity included for comparison:

As the chart makes clear, both the age 35 and the age 55 DC (non-annuitizing) participants have done well this year. Currently, they are able to buy (in $2020, that is, after adjusting for inflation) significantly more retirement income than they could at the beginning of the year.

Compare the performance of the DB participant’s annuity, which lost value (because of inflation) against its beginning of the year value of $1,000 (again, in $2020). An identical fate would have befallen our DC participants, if they had annuitized at the beginning of the year.

17. This risk (the loss of nominal buying power to inflation) may be explicitly hedged if the participant buys a (very costly) inflation-protected annuity.

18. Thus, adding an annuity component to a DC plan investment adds inflation risk.

19. In this context, DC sponsors may want to provide inflation hedging investments as an option, especially for annuitizing participants. And annuitizing participants themselves may want to consider outside-the-plan investments that are inflation hedging. Finally, in the current context, DC plan sponsors may want to reconsider annuitization strategy.