April 2024 Annuity Purchase Update

Due to the major purchases with Verizon Communications and Shell, Q1 of 2024 is marked as one of the highest premium volumes in history.

The average annuity purchase interest rates in April have remained consistent with the ongoing trend, with the average duration 7 rate at 4.80% and the average duration 15 rate at 4.74%, making it an opportune time to purchase annuities.

Due to robust equity markets and favorable interest rates, the funded status of plans has increased, which is continuing the appeal to plan sponsors to enter the pension risk transfer marketplace.

Q1 of 2024 is marked as one of the highest premium volumes in history, attributed by the purchases made with Verizon Communications Inc. and Shell’s purchase.

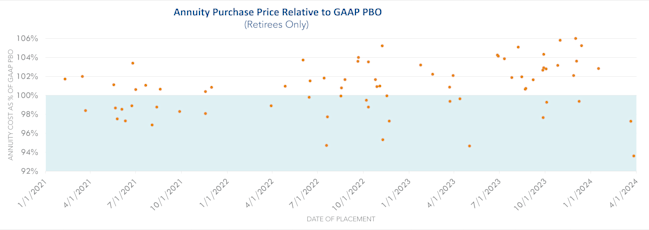

The spread for Annuity Plan 1 relative to GAAP PBO has gone negative for the first time ever. We have witnessed this aggressive pricing in our own cases, as our last retiree carve-out of the quarter settled at 93.59% of GAAP PBO.

Since the beginning of the month, annuity purchase interest rates experienced a spike due to the latest jump in inflation.

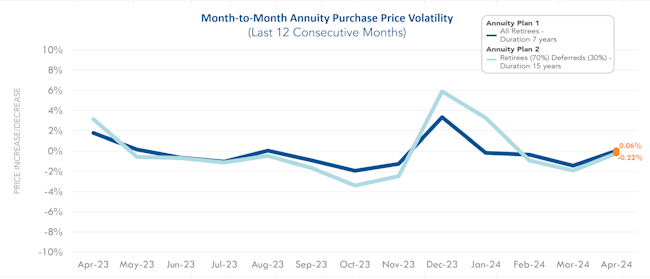

As we transition into the second quarter of 2024, we observed a gradual upward trend overall for annuity purchase interest rates in quarter one. The graph below illustrates a minimal shift in annuity purchase rates between March and April. The duration 7 interest rate dipped to 4.80% while the duration 15 interest rate rose slightly to 4.74%. However, since the beginning of the month, rates have increased. Up to this point in 2024, rates have been fairly stable from month to month. Since the beginning of the year, annuity purchase rates have followed an upward pattern. Nevertheless, it is important to keep in mind that there is no guarantee that annuity purchase interest rates will continue to follow this pattern as the year progresses. As mentioned in the Pension Finance Update, funding status improved due to strong stock market returns. With that said, plan sponsors are strongly advised to enter the marketplace as soon as feasible to optimize savings and secure their transactions.

The spread between the 10-year and 30-year treasury rates remained consistent with their spread from last month, remaining 14 basis points apart. This month, the 10-year treasury rate increased to 4.33% and the 30-year treasury rate also jumped up to 4.47%. Since the beginning of the month, treasury rates have increased nearly 20 basis points. The rise in both the 10-year and 30-year treasury rates is presumably due to the recent inflation rate. As illustrated in the graph below, both annuity interest rates and treasury rates fluctuate over time and are unpredictable. Given the volatility in rates and the continued increase in market activity, a timely entry into the marketplace is critical for plan sponsors to receive favorable rates.

Top 3 ways PRT is lowering plan costs

The graph below shows the spread between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. For Annuity Plan 1, the spread decreased to -0.03%, marking the first instance where the annuity purchase price has fallen below the GAAP PBO. The spread for Annuity Plan 2 also narrowed to 3.31%. This presents excellent opportunities for plan sponsors to capitalize on savings and secure advantageous rates upon entering the marketplace. An increase in annuity purchase rates inversely lowers annuity purchase prices relative to accounting book value. Please note that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

The graph below represents the annuity purchase price relative to GAAP projected benefit obligation (PBO) of the retiree cases placed by October Three Annuity Services since 2021. In 2023, annuity purchase cost for retirees was on average 102.52% of the accounting book value. Since 2021, the average purchase cost was 101.03% of GAAP PBO. At the end of the first quarter of 2024, October Three Annuity services closed two placements below GAAP PBO. With attractive rates and aggressive pricing from carriers, one transaction closed at 97.25% of GAAP PBO and the other at 93.59% of GAAP PBO. Consistent with the marketplace, October Three Annuity services also hit a record high in volume of transactions in 2023. Marketplace activity is spilling into 2024 and carriers are beginning to fill their calendars rapidly.

Annuity purchase interest rates in 2024 have displayed lower volatility compared to the end of 2023, however annuity purchase interest rates are unpredictable. This month the annuity purchase price increased for Annuity Plan 1 by 0.06% and decreased 0.22% for Annuity Plan 2. Considering that annuity purchase interest rates are influenced by the market and fluctuate daily, it is crucial for plan sponsors to strategize their entry into the pension risk transfer marketplace. Plan sponsors can capitalize on the advantageous fluctuations with annuity purchase prices in a volatile market by connecting with annuity search firms early.

Predicting future pension risk transfer market changes remains and will continue to be challenging. While 2024 has shown steady rates up to now, there is no prediction on whether the remainder of the year will follow suit due to market volatility. It is important to keep in mind that annuity purchases can be made selectively rather than all at once. Since PBGC premiums do not vary based on the size of participant’s benefits, plan sponsors should consider doing a retiree-carveout for retirees with small benefits to secure PBGC savings. Plan sponsors should connect with annuity search firms early to explore avenues for maximizing savings.