July 2023 Annuity Purchase Update

The third and fourth quarter are in full gear as slots are filling up and insurers are reaching capacity constraints. Plan Sponsors who would like to transact this year should connect with an annuity search firm immediately to achieve their de-risking goals.

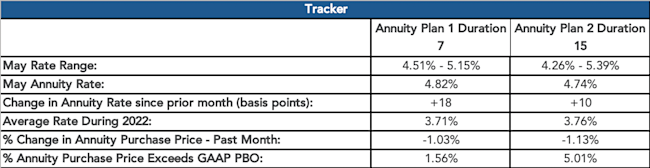

· Average annuity purchase interest rates increased again, rising 18 basis points for the duration 7 rate and 10 basis points for duration 15 rate since June.

· Closing out the first half of the year, insurers noted an increased number of plan terminations and expect to see a similar pattern moving into the remainder of the year.

· Pension Finance improved last month and annuity purchase rates climbed as well, making it an opportune time to enter the pension risk transfer marketplace.

· Preliminary data indicates a record high of annuity inquiries in the first half of the year.

· Insurance carriers have already expressed capacity constraints for September. In anticipation of the upcoming PRT market rush, plan sponsors should act now to secure a spot in 2023.

Narrative

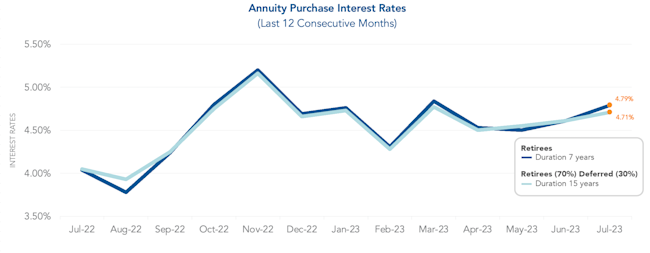

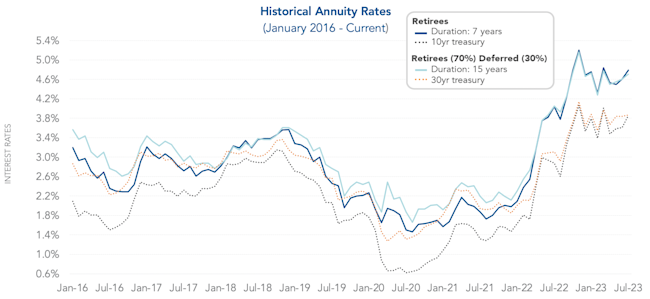

After wrapping up a strong first half of the year, we kicked off the third quarter with another increase in average annuity purchase interest rates. In the last twelve months, the average duration 7 annuity rate increased by 75 basis points, while the average duration 15 annuity rate increased by 66 basis points. The gradual upward trend in rates provides favorable market conditions for a plan sponsor. As noted in the Pension Finance Update, strong stock market returns improved pension funding status. Attractive annuity purchase interest rates and improved funding status are driving plan sponsors to settle all or a portion of their pension liability. Insurance companies have recognized an increased popularity in annuity inquiries in the first half of the year. There is no anticipation of marketplace activity slowing down for the remainder of the year. It is encouraged to connect with a plan sponsor to enter the marketplace sooner rather than later to lock down favorable rates in this active market.

Annuity purchase interest rates rose for the second month in a row, with the average Duration 7 annuity purchase interest rate at 4.79% and the average Duration 15 annuity purchase interest rate at 4.71%. The spread between the 10-year treasury rate and 30-year treasury rate narrowed, placing the two rates one basis point apart. As of the beginning of July, the 10-year treasury rate increased to 3.86% and 30-year treasury rate bumped to 3.87%. Due to favorable interest rates thus far in 2023, the marketplace continues to stay busy and insurers are already preparing for the fourth quarter rush. Some insurers are even experiencing capacity constraints given the volume of placements. Entering the marketplace in a timely manner is important in order to maximize savings.

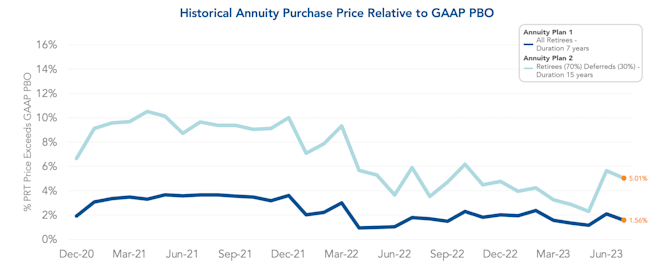

Top 3 ways PRT is lowering plan costs

The graph below shows the spread between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In June, we observed the spread between annuity purchase price above GAAP PBO for both plans widen dramatically. In July, the spread narrowed. For Annuity Plan 1, the spread decreased to 1.56% and Annuity Plan 2 decreased to 5.01%. The current spread for both hypothetical plans are lower than the historical averages. An increase in annuity purchase rates inversely lowers annuity purchase prices relative to accounting book value. Please note that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs.

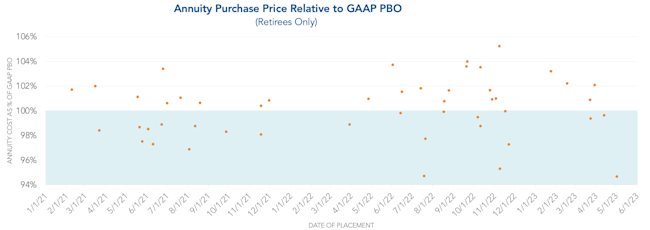

The graph below represents the annuity purchase price relative to GAAP projected benefit obligation (PBO) of the retiree cases placed by October Three Annuity Services since 2021. As we transition into the third quarter with high interest rates and increased plan funding, we will continue to see more placements at October Three. In the first half of 2023, annuity purchase cost for retirees was on average 100.28% of GAAP PBO. Historically, the vast majority of market activity occurred in the third and fourth quarters. This year, insurers have experienced a consistent rush which they anticipate will remain in the second half of the year.

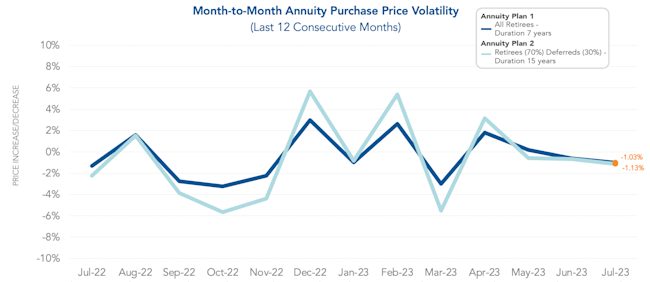

While interest rates rose the past two months, annuity purchase costs were favorable. This month the annuity purchase price decreased for Annuity Plan 1 by 1.03% and for Annuity Plan 2 by 1.13%. As seen below, there is short-term volatility in the pension risk transfer market. Although the graph below shows a month to month fluctuation, annuity purchase interest rates are market dependent and actually fluctuate daily. To hedge against this short term volatility, a plan sponsor terminating their pension plan could settle the retiree portion of their liability to "lock in" favorable rates.

Additional Risk Mitigation Strategies to Consider

As we close out the first half of the year, it is clear that 2023 is a busy year for pension risk transfer. Annuity purchases do not need to occur on an all-or-nothing basis. PBGC premiums for participants do not vary based on the size of the participant's benefit. A plan sponsor should consider purchasing annuities for a subset of the retiree population with small benefits to guarantee PBGC savings. In such an active marketplace it is crucial to connect with an annuity search firm early on in order to consider the best options to de-risk your plan. Retiree population with small benefits to guarantee PBGC savings

Have a pension risk transfer need but not sure where to start? See our article, What to look for when comparing Annuity Search Firms

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Monthly annuity rates are determined by taking the average Duration 7 and Duration 15 interest rates provided from the insurers. Annuity Plan 1 was valued using the average of the Duration 7 year interest rates collected from insurers and Annuity Plan 2 was valued using the average of the Duration 15 year interest rates collected from insurers. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.