March 2024 Annuity Purchase Update

There has been another notable transaction for 2024, with Verizon Communications, Inc. resolving approximately $5.9 billion in pension liabilities.

As the Pension Risk Transfer market continues to augment, it is vital for plan sponsors to connect with an annuity search firm early on to keep a close eye on the annuity purchase market when contemplating de-risking strategies.

Despite the beginning quarters being traditionally a slower time in the pension risk transfer market, the Verizon transaction as well as Shell’s February purchase have significantly increased the premium volume for Q1.

The outlook for plan sponsors appears promising for plan sponsors as interest rates, market activity, and pension funding improved this last month.

Annuity purchase cost for retiree placements completed by October Three Annuity Services was on average 101.2% of the pension accounting value (GAAP PBO).

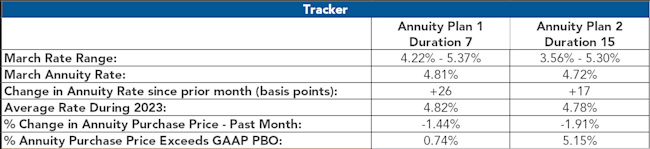

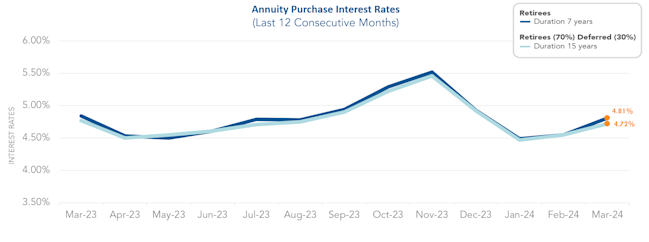

As we near the end of the first quarter in 2024, annuity purchase interest rates have displayed stable trends, with each month showing a slight increase. As mentioned in the Pension Finance update, with the start of the year showing quieter activity, pension funding experienced improvement, buoyed by higher interest rates, and accompanied by robust stock markets. Annuity Purchase Interest Rates also experienced another increase this past month which corresponds with a decrease in Annuity Purchase cost. The duration 7 annuity rate increased 26 basis points while the duration 15 annuity rate increased 22 basis points. This put the average duration 7 annuity purchase rate at 4.88% and the average duration 15 annuity purchase rate at 4.77%. As evident by the jump in annuity purchase interest rates this month, there is a sense of optimism, signaling to plan sponsors the importance of entering the pension risk transfer marketplace early to secure their spot. As we head into the second quarter of 2024, the market rush is anticipated to persist, making it imperative for plan sponsors to begin connecting with annuity search firms early to capitalize on favorable pricing.

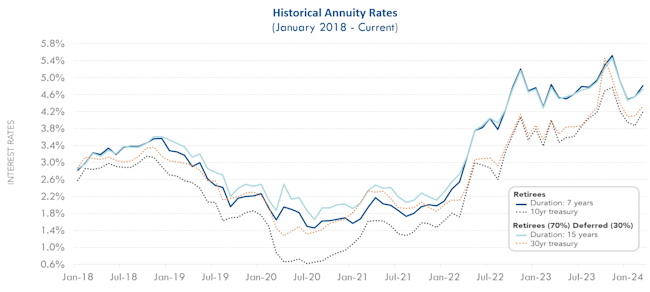

As we’ve seen and learned based on historical data, annuity purchase interest rates and treasury rates fluctuate over time and are capable of spiking or dropping dramatically. The 10-year treasury year yields correlate with the duration 7 annuity purchase interest rate, while similarly the 30-year treasury yields correlate with the 15-year annuity purchase interest rate. The spread between the 10-year treasury rate and 30-year treasury rate narrowed, placing the two rates 14 basis points apart. As of March 1, the 10-year treasury rate heightened to 4.19% while the 30-year treasury rate increased to 4.33%. Since the beginning of the month, we have observed a slight dip in treasury rates. The Pension Risk Transfer market experienced a shock by the latest rate of inflation last month. This increased the probability of a rate cut by the Fed later in the year. Entering the marketplace promptly will allow for plan sponsors to exploit market conditions when favorable.

Top 3 ways PRT is lowering plan costs

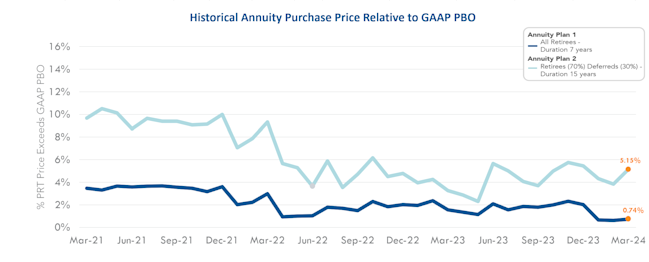

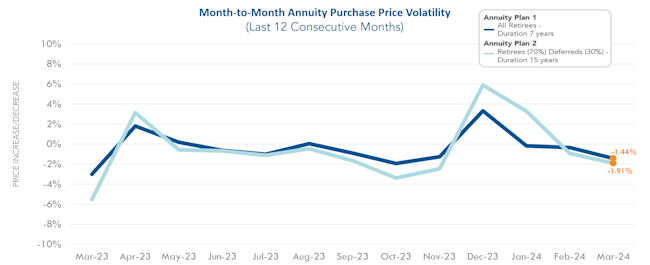

The graph below shows the spread between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In the last month, the spread between annuity purchase prices above GAAP PBO widened significantly. For Annuity Plan 1, the spread increased to 0.74% and for Annuity Plan 2, the spread jumped to 5.15%. The current spread for both plans remain below historical averages. An increase in annuity purchase rates inversely lowers annuity purchase prices relative to accounting book value. Please note that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

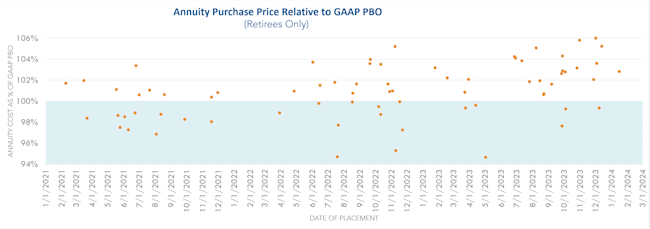

The graph below represents the annuity purchase price relative to GAAP projected benefit obligation (PBO) of the retiree cases placed by October Three Annuity Services since 2021. We kicked off 2024 with a purchase that closed at 102.53% of GAAP PBO. In 2023, annuity purchase cost for retirees was on average 102.52% of the accounting book value. Since 2021, the average purchase cost was 101.2% of GAAP PBO. Consistent with the marketplace, October Three Annuity services also hit a record high in volume of transactions in 2023. Marketplace activity is spilling into 2024 and carriers are beginning to fill their calendars rapidly.

As you can see below, month-to-month annuity purchase costs undergo fluctuations. In the past month, the annuity purchase price for Annuity Plan 1 dropped 1.44% and Annuity Plan 2 decreased 1.91%. So far in 2024, we have observed a consistent downward trend in annuity purchase prices. As proven historically, timing an early entry into the pension risk transfer marketplace is a crucial aspect of the planning state, given the consistent short-term volatility of annuity pricing. Early entry in the marketplace also encourages competition so connecting with an annuity search firm early enables plan sponsors to de-risk their plans at favorable prices.

Last year was a record year in terms of the number of transactions for the Pension Risk Transfer Market. Although annuity purchase rates took a hit the last few months of 2023, the consistent increase in rates this year is encouraging plan sponsors to take strides to de-risk their pension plans. Robust market activity made it impossible for plan sponsors to transact as the fourth quarter was closing. Insurance carriers have already expressed anticipation of capacity constraints. Plan Sponsors should consider connecting with an annuity search firm and getting data in good order sooner rather than later to avoid the capacity constraint hurdles that will arise later in the year. Annuity purchases do not need to occur on an all-or-nothing basis so to capitalize on favorable market conditions, a plan sponsor should consider purchasing annuities for a subset of the retiree population with small benefits. PBGC premiums for participants do not vary based on the size of the participant's benefit. Purchasing annuities for a subset of the population would guarantee PBGC savings.