May 2023 Annuity Purchase Update

AT&T took advantage of favorable market conditions and purchased roughly $8.1 billion in annuities

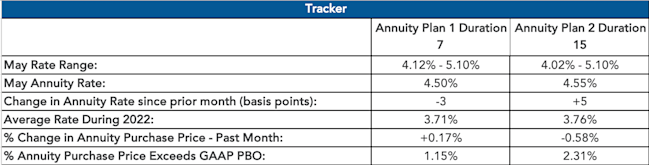

· Average annuity purchase interest rates in May stayed on current trend with the average duration 7 rate at 4.50% and average duration 15 annuity purchase rate at 4.55%, making it a great time to purchase annuities.

· Preliminary data suggests there was a significant interest in annuity purchases in the first quarter, totaling over $6 billion in premium. The second quarter is expected to exceed this as AT&T purchased $8.1 billion in annuities this month alone. *

· Plan Sponsors are taking steps toward plan termination, as plan termination annuity purchases dominated the market during the first quarter of the year.

· October Three Annuity Services closed two more retiree cases in April, both of which fell well below the GAAP PBO at 99.62% and 94.65%.

*Data based on survey conducted by O3 Annuity services, and waiting on additional data from insurance carriers

Narrative

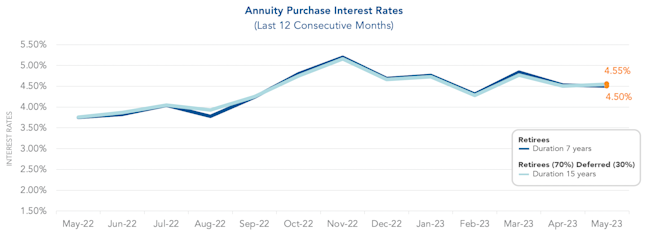

Though annuity purchase interest rates have been more volatile in 2023, the graph below shows annuity purchase interest rates changed very slightly from April to May. The average duration 7 annuity rate dipped to 4.50% and the average duration 15 annuity rate increased slightly to 4.55%. Currently the rates show consistency from April to May, however, there is no guarantee that interest rates will continue with such consistency moving forward. Annuity purchases do not need to occur on an all or nothing basis. To hedge the risk of market volatility, plan sponsors could consider settling the retiree liability first. Now more than ever plan sponsors are preparing for annuity purchases. We continue to encourage plan sponsors to enter the marketplace sooner rather than later to maximize savings.

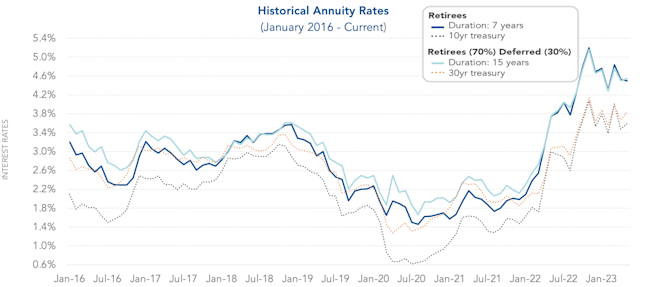

Maintaining a small spread between the two durations, the average duration 7 annuity rate is 4.50% and the average duration 15 annuity purchase rate is 4.55%. Similarly, as shown in the graph below there is a very small spread between the 10-year treasury rates and 30-year treasury rates. The average annuity interest rates have been higher in 2023 than the average rates observed in 2022. As seen in the graph below, annuity interest rates and treasury rates vary over time. Given the volatility in rates and surge in market activity, a timely entry into the marketplace is critical for plan sponsors to receive favorable pricing.

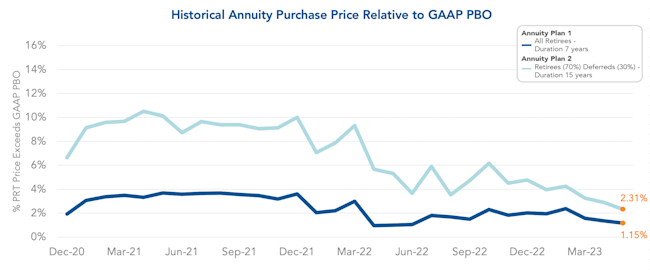

Top 3 ways PRT is lowering plan costs

The graph below shows the spread between annuity purchase price above GAAP projected benefit obligation (PBO). We refer to GAAP PBO and accounting book value interchangeably. In the graph below the spread between the GAAP PBO has narrowed significantly. For Annuity Plan 2, the annuity purchase price is the closest it has ever been to the GAAP PBO at a spread of 2.31%. In 2021, the average spread for Annuity Plan 1 was 3.35% above GAAP PBO and the average spread for Annuity Plan 2 was 9.31% above GAAP PBO. In 2022, the average spread for Annuity Plan 1 was 1.92% above GAAP PBO and the average for Annuity Plan 2 was 6.04% above GAAP PBO. The current spread for both hypothetical plans are significantly lower than the historical averages. An increase in annuity purchase rates inversely lowers annuity purchase prices relative to accounting book value. Please note that the below PBO calculations exclude future overhead costs paid by plan sponsors to retain participants in the plan. Administrative expenses and PBGC premiums are examples of these overhead costs. Future overhead costs would narrow the spread, though the extent is plan specific.

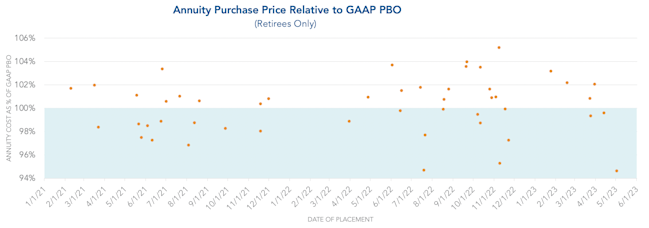

The graph below represents the annuity purchase price relative to GAAP projected benefit obligation (PBO) of the actual retiree cases placed by October Three Annuity Services since 2021. Historically, the annuity purchase cost was consistently between 94.5% – 105% of the pension accounting value with the average at 100.14%. This month October Three closed two more retiree placements, both premiums falling below the GAAP PBO. As seen below, roughly 50% of the placements have been priced below GAAP PBO. PBO calculations exclude fees. Historically, the vast majority of market activity occurs in the third and fourth quarters. We typically see a rush closer to the end of the year, however the first quarter of 2023 has been vigorous. The Pension Risk Transfer Market kicked off 2023 with a strong start and we anticipate this activity to continue throughout the year.

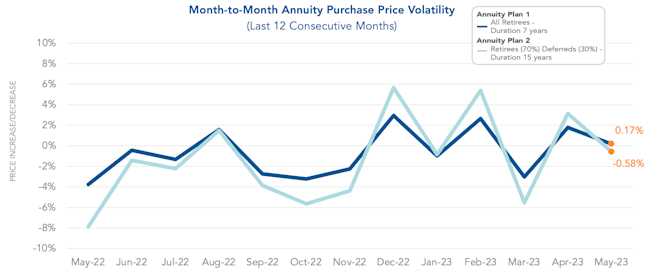

Annuity purchase costs shift from month to month. Since last month, the purchase price increased for Annuity Plan 1 by 0.17% and decreased for Annuity Plan 2 by 0.58%. An early entrance to the insurance market is an important component of completing a Pension Risk Transfer transaction because of the short-term volatility of annuity pricing. The earlier a plan sponsor can enter the Pension Risk Transfer market, the more likely plan sponsors can capitalize on favorable changes in the market.

Additional Risk Mitigation Strategies to Consider

It continues to be difficult to predict any future market changes. Though this past month the annuity purchase interest rates stayed consistent, there is no prediction that next month will be the same given the volatility of the market. Annuity purchases for plan sponsors do not need to occur on an all-or-nothing basis, for there is still a benefit for going into a marketplace ready for a retiree lift out. Plan sponsors pay PBGC premiums for participants that do not vary based on the size of the participant’s benefit. A Plan Sponsor should consider purchasing annuities for a subset of the retiree population with small benefits to guarantee PBGC savings

Have a pension risk transfer need but not sure where to start? See our article, What to look for when comparing Annuity Search Firms

*October Three advises plan sponsors through every step of the Pension Risk Transfer (PRT) process. Through long established relationships with insurers in the PRT marketplace, October Three collects annuity purchase rates for Duration 7 years and Duration 15 years on a monthly basis. We have constructed 2 hypothetical annuity plans which have been valued using the latest mortality tables and mortality improvement scales. Annuity Plan 1 contains retirees only and has a liability duration of 7 years. Annuity Plan 2 contains 70% retirees and 30% deferreds and has a liability duration of 15 years. Monthly annuity rates are determined by taking the average Duration 7 and Duration 15 interest rates provided from the insurers. Annuity Plan 1 was valued using the average of the Duration 7 year interest rates collected from insurers and Annuity Plan 2 was valued using the average of the Duration 15 year interest rates collected from insurers. Using the collected annuity purchase rates and 2 hypothetical annuity plans, we have produced the following graphs representative of actual PRT market activity and the corresponding impact on pension plans.